Authors

Summary

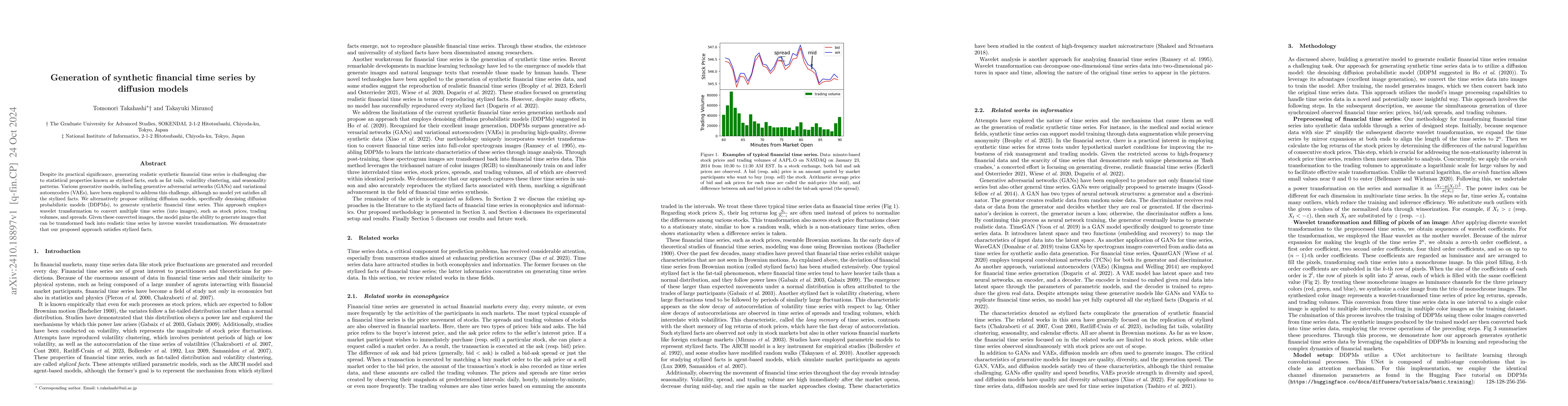

Despite its practical significance, generating realistic synthetic financial time series is challenging due to statistical properties known as stylized facts, such as fat tails, volatility clustering, and seasonality patterns. Various generative models, including generative adversarial networks (GANs) and variational autoencoders (VAEs), have been employed to address this challenge, although no model yet satisfies all the stylized facts. We alternatively propose utilizing diffusion models, specifically denoising diffusion probabilistic models (DDPMs), to generate synthetic financial time series. This approach employs wavelet transformation to convert multiple time series (into images), such as stock prices, trading volumes, and spreads. Given these converted images, the model gains the ability to generate images that can be transformed back into realistic time series by inverse wavelet transformation. We demonstrate that our proposed approach satisfies stylized facts.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCoFinDiff: Controllable Financial Diffusion Model for Time Series Generation

Takehiro Takayanagi, Kiyoshi Izumi, Yuki Tanaka et al.

Causal Time Series Generation via Diffusion Models

Jiang Bian, Chang Xu, Roger Zimmermann et al.

NetDiffus: Network Traffic Generation by Diffusion Models through Time-Series Imaging

Kanchana Thilakarathna, Chamara Madarasingha, Nirhoshan Sivaroopan et al.

No citations found for this paper.

Comments (0)