Summary

The generation of synthetic financial data is a critical technology in the financial domain, addressing challenges posed by limited data availability. Traditionally, statistical models have been employed to generate synthetic data. However, these models fail to capture the stylized facts commonly observed in financial data, limiting their practical applicability. Recently, machine learning models have been introduced to address the limitations of statistical models; however, controlling synthetic data generation remains challenging. We propose CoFinDiff (Controllable Financial Diffusion model), a synthetic financial data generation model based on conditional diffusion models that accept conditions about the synthetic time series. By incorporating conditions derived from price data into the conditional diffusion model via cross-attention, CoFinDiff learns the relationships between the conditions and the data, generating synthetic data that align with arbitrary conditions. Experimental results demonstrate that: (i) synthetic data generated by CoFinDiff capture stylized facts; (ii) the generated data accurately meet specified conditions for trends and volatility; (iii) the diversity of the generated data surpasses that of the baseline models; and (iv) models trained on CoFinDiff-generated data achieve improved performance in deep hedging task.

AI Key Findings

Generated Jun 10, 2025

Methodology

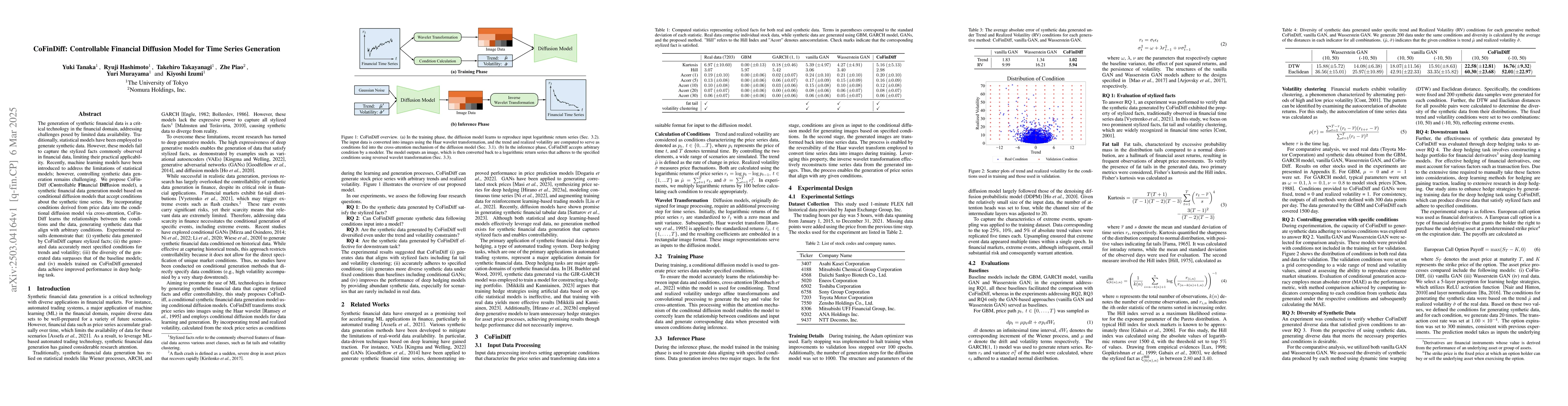

The research proposes CoFinDiff, a controllable financial diffusion model for time series generation, which uses conditional diffusion models to generate synthetic financial data that align with specified conditions, such as trends and volatility, by incorporating conditions derived from price data via cross-attention.

Key Results

- Synthetic data generated by CoFinDiff capture stylized facts such as fat tails and volatility clustering.

- Generated data accurately meet specified conditions for trends and volatility.

- CoFinDiff-generated data show higher diversity compared to baseline models.

- Models trained on CoFinDiff-generated data achieve improved performance in deep hedging tasks.

Significance

This research is significant as it addresses the challenge of limited data availability in the financial domain by proposing a novel method for generating synthetic financial data that aligns with specific conditions, which can be beneficial for model training and risk management.

Technical Contribution

CoFinDiff, a conditional diffusion model for financial time series generation that incorporates conditions via cross-attention, enabling the generation of synthetic data that align with specified trends and volatility conditions.

Novelty

CoFinDiff introduces a novel approach to synthetic financial data generation by leveraging conditional diffusion models and cross-attention, which effectively captures stylized facts and adheres to arbitrary conditions, surpassing baseline models in diversity and performance in downstream tasks.

Limitations

- The paper does not discuss potential limitations or challenges encountered during the development or evaluation of CoFinDiff.

- No information on scalability or computational efficiency of the proposed model.

Future Work

- Explore the generation of synthetic data for specific stocks by conditioning on stock identifiers.

- Adapt the model to capture correlations between multiple stocks, enabling the generation of multi-stock price series.

- Extend the conditions used in the generation process to allow for more flexible conditional generation.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGeneration of synthetic financial time series by diffusion models

Takayuki Mizuno, Tomonori Takahashi

A Financial Time Series Denoiser Based on Diffusion Model

Carmine Ventre, Zhuohan Wang

Towards Controllable Time Series Generation

Zhiyong Huang, Qiang Huang, Anthony K. H. Tung et al.

Controllable Financial Market Generation with Diffusion Guided Meta Agent

Yang Liu, Wu-Jun Li, Weiqing Liu et al.

No citations found for this paper.

Comments (0)