Summary

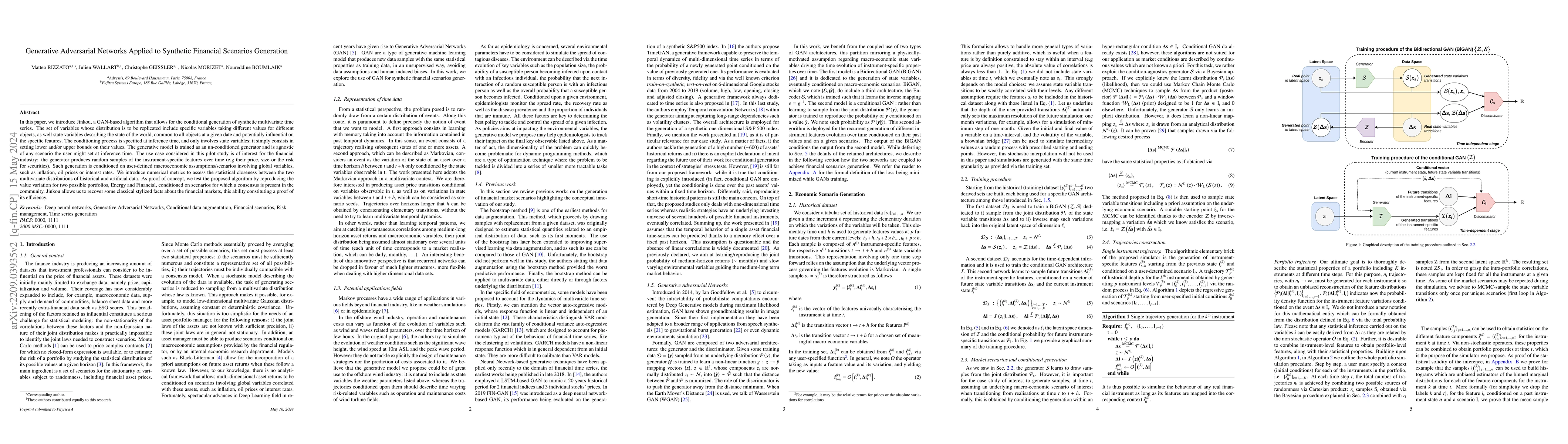

The finance industry is producing an increasing amount of datasets that investment professionals can consider to be influential on the price of financial assets. These datasets were initially mainly limited to exchange data, namely price, capitalization and volume. Their coverage has now considerably expanded to include, for example, macroeconomic data, supply and demand of commodities, balance sheet data and more recently extra-financial data such as ESG scores. This broadening of the factors retained as influential constitutes a serious challenge for statistical modeling. Indeed, the instability of the correlations between these factors makes it practically impossible to identify the joint laws needed to construct scenarios. Fortunately, spectacular advances in Deep Learning field in recent years have given rise to GANs. GANs are a type of generative machine learning models that produce new data samples with the same characteristics as a training data distribution in an unsupervised way, avoiding data assumptions and human induced biases. In this work, we are exploring the use of GANs for synthetic financial scenarios generation. This pilot study is the result of a collaboration between Fujitsu and Advestis and it will be followed by a thorough exploration of the use cases that can benefit from the proposed solution. We propose a GANs-based algorithm that allows the replication of multivariate data representing several properties (including, but not limited to, price, market capitalization, ESG score, controversy score,. . .) of a set of stocks. This approach differs from examples in the financial literature, which are mainly focused on the reproduction of temporal asset price scenarios. We also propose several metrics to evaluate the quality of the data generated by the GANs. This approach is well fit for the generation of scenarios, the time direction simply arising as a subsequent (eventually conditioned) generation of data points drawn from the learned distribution. Our method will allow to simulate high dimensional scenarios (compared to $\lesssim10$ features currently employed in most recent use cases) where network complexity is reduced thanks to a wisely performed feature engineering and selection. Complete results will be presented in a forthcoming study.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSynthetic flow-based cryptomining attack generation through Generative Adversarial Networks

Edgar Talavera, Ángel González-Prieto, Alberto Mozo et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)