Summary

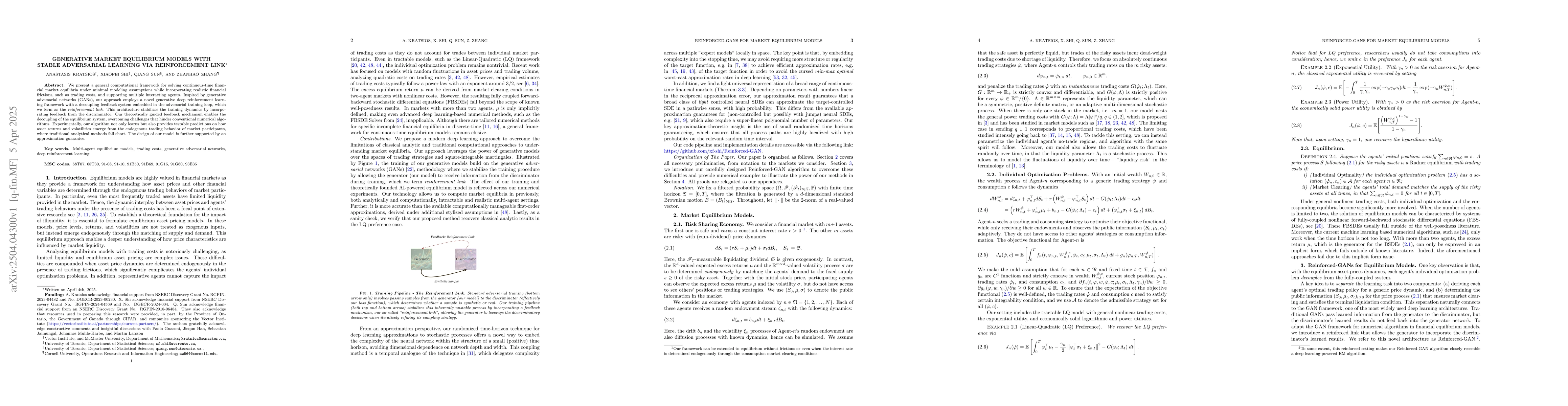

We present a general computational framework for solving continuous-time financial market equilibria under minimal modeling assumptions while incorporating realistic financial frictions, such as trading costs, and supporting multiple interacting agents. Inspired by generative adversarial networks (GANs), our approach employs a novel generative deep reinforcement learning framework with a decoupling feedback system embedded in the adversarial training loop, which we term as the \emph{reinforcement link}. This architecture stabilizes the training dynamics by incorporating feedback from the discriminator. Our theoretically guided feedback mechanism enables the decoupling of the equilibrium system, overcoming challenges that hinder conventional numerical algorithms. Experimentally, our algorithm not only learns but also provides testable predictions on how asset returns and volatilities emerge from the endogenous trading behavior of market participants, where traditional analytical methods fall short. The design of our model is further supported by an approximation guarantee.

AI Key Findings

Generated Jun 10, 2025

Methodology

The paper proposes a computational framework using generative deep reinforcement learning with a reinforcement link to stabilize training dynamics in adversarial training, addressing challenges faced by conventional numerical algorithms in solving continuous-time financial market equilibria.

Key Results

- The framework successfully learns and provides testable predictions on asset returns and volatilities from endogenous trading behavior of market participants.

- The decoupling feedback system embedded in the adversarial training loop stabilizes training dynamics and overcomes limitations of traditional analytical methods.

Significance

This research is important as it offers a novel approach to model complex financial markets under realistic frictions, providing insights where analytical methods fall short, and potentially impacting financial modeling and policy-making.

Technical Contribution

The main technical contribution is the introduction of a reinforcement link within the adversarial training loop, which stabilizes training and enables decoupling of the equilibrium system.

Novelty

The paper's novelty lies in combining generative adversarial networks with reinforcement learning to model financial market equilibria, addressing challenges of stability and scalability in existing methods.

Limitations

- The paper does not discuss potential limitations of the proposed method in handling extreme market conditions or very large numbers of agents.

- Generalizability of the model to diverse market structures and regulatory environments is not explicitly addressed.

Future Work

- Further exploration of model performance under various market scenarios and regulatory frameworks.

- Investigating scalability of the approach for markets with a vast number of interacting agents.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGenerative Adversarial Exploration for Reinforcement Learning

Yong Yu, Weinan Zhang, Peng Sun et al.

Generative Adversarial Equilibrium Solvers

David C. Parkes, Georgios Piliouras, Andrea Tacchetti et al.

No citations found for this paper.

Comments (0)