Summary

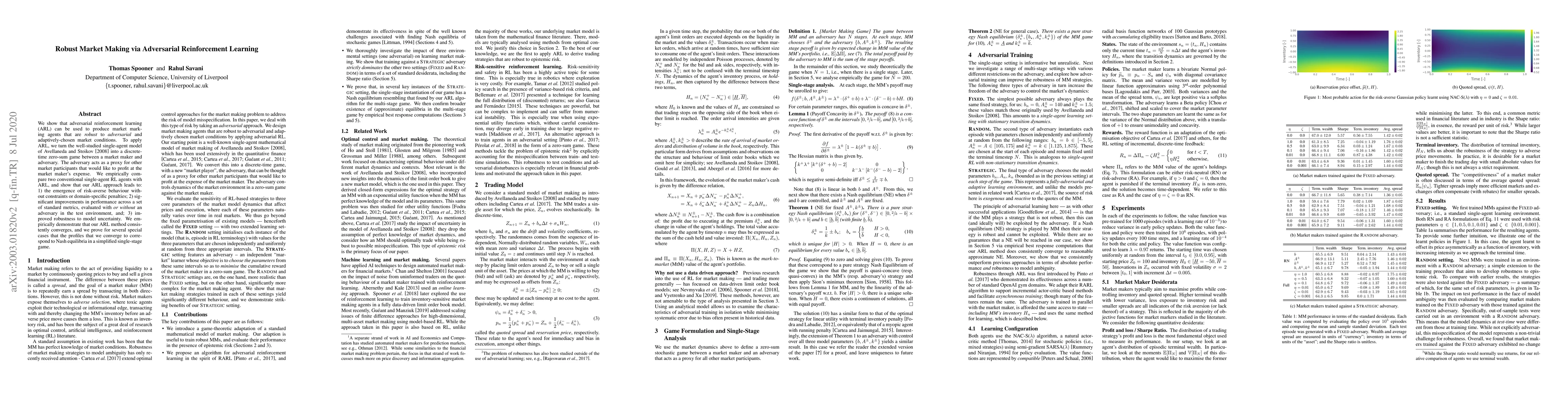

We show that adversarial reinforcement learning (ARL) can be used to produce market marking agents that are robust to adversarial and adaptively-chosen market conditions. To apply ARL, we turn the well-studied single-agent model of Avellaneda and Stoikov [2008] into a discrete-time zero-sum game between a market maker and adversary. The adversary acts as a proxy for other market participants that would like to profit at the market maker's expense. We empirically compare two conventional single-agent RL agents with ARL, and show that our ARL approach leads to: 1) the emergence of risk-averse behaviour without constraints or domain-specific penalties; 2) significant improvements in performance across a set of standard metrics, evaluated with or without an adversary in the test environment, and; 3) improved robustness to model uncertainty. We empirically demonstrate that our ARL method consistently converges, and we prove for several special cases that the profiles that we converge to correspond to Nash equilibria in a simplified single-stage game.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMarket Making via Reinforcement Learning in China Commodity Market

Junshu Jiang, Thomas Dierckx, Wim Schoutens et al.

Over-the-Counter Market Making via Reinforcement Learning

Zhou Fang, Haiqing Xu

| Title | Authors | Year | Actions |

|---|

Comments (0)