Summary

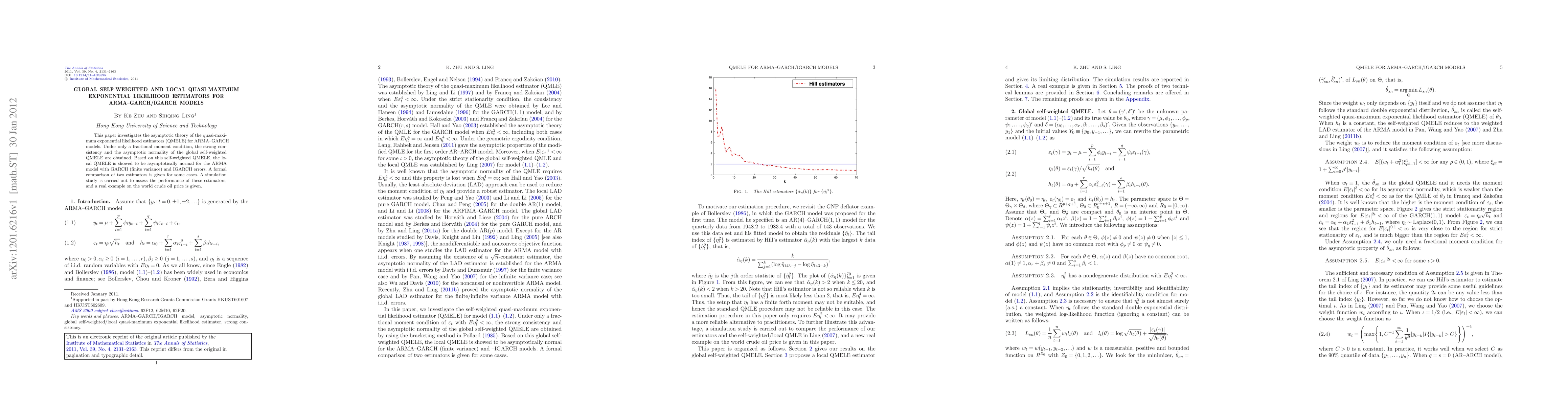

This paper investigates the asymptotic theory of the quasi-maximum exponential likelihood estimators (QMELE) for ARMA--GARCH models. Under only a fractional moment condition, the strong consistency and the asymptotic normality of the global self-weighted QMELE are obtained. Based on this self-weighted QMELE, the local QMELE is showed to be asymptotically normal for the ARMA model with GARCH (finite variance) and IGARCH errors. A formal comparison of two estimators is given for some cases. A simulation study is carried out to assess the performance of these estimators, and a real example on the world crude oil price is given.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)