Authors

Summary

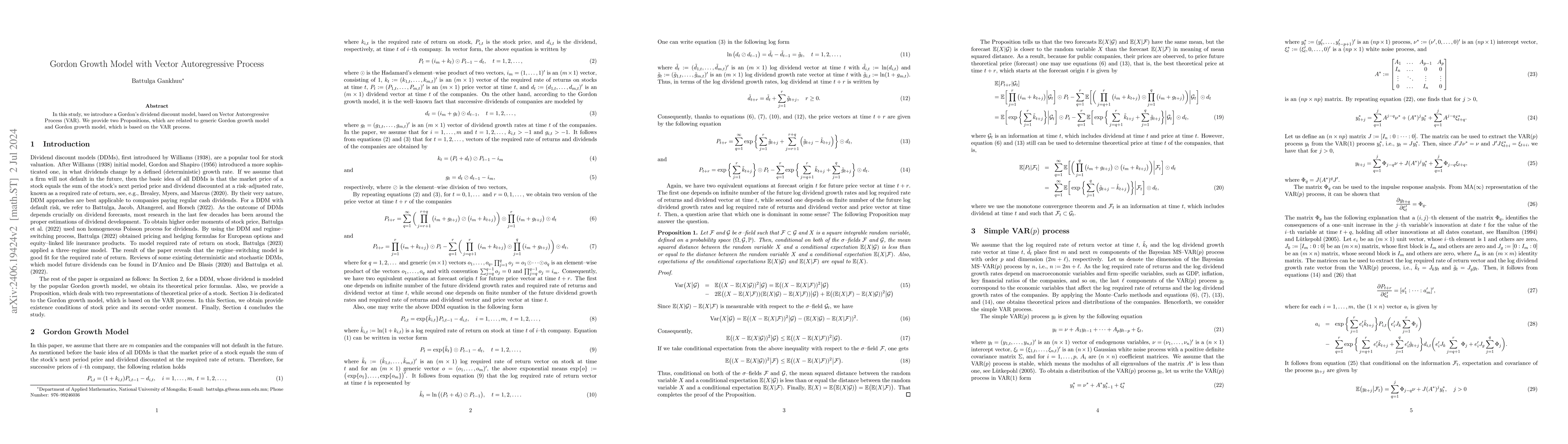

In this study, we introduce a Gordon's dividend discount model, based on Vector Autoregressive Process (VAR). We provide two Propositions, which are related to generic Gordon growth model and Gordon growth model, which is based on the VAR process.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)