Summary

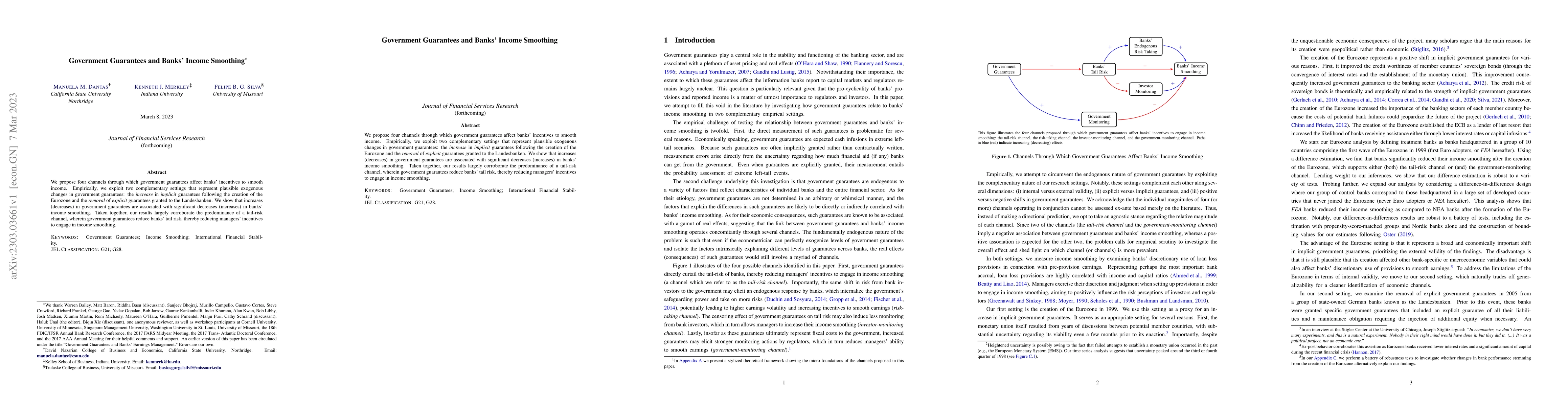

We propose four channels through which government guarantees affect banks' incentives to smooth income. Empirically, we exploit two complementary settings that represent plausible exogenous changes in government guarantees: the increase in implicit guarantees following the creation of the Eurozone and the removal of explicit guarantees granted to the Landesbanken. We show that increases (decreases) in government guarantees are associated with significant decreases (increases) in banks' income smoothing. Taken together, our results largely corroborate the predominance of a tail-risk channel, wherein government guarantees reduce banks' tail risk, thereby reducing managers' incentives to engage in income smoothing.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)