Summary

This paper designs a sequential repeated game of a micro-founded society with three types of agents: individuals, insurers, and a government. Nascent to economics literature, we use Reinforcement Learning (RL), closely related to multi-armed bandit problems, to learn the welfare impact of a set of proposed policy interventions per $1 spent on them. The paper rigorously discusses the desirability of the proposed interventions by comparing them against each other on a case-by-case basis. The paper provides a framework for algorithmic policy evaluation using calibrated theoretical models which can assist in feasibility studies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

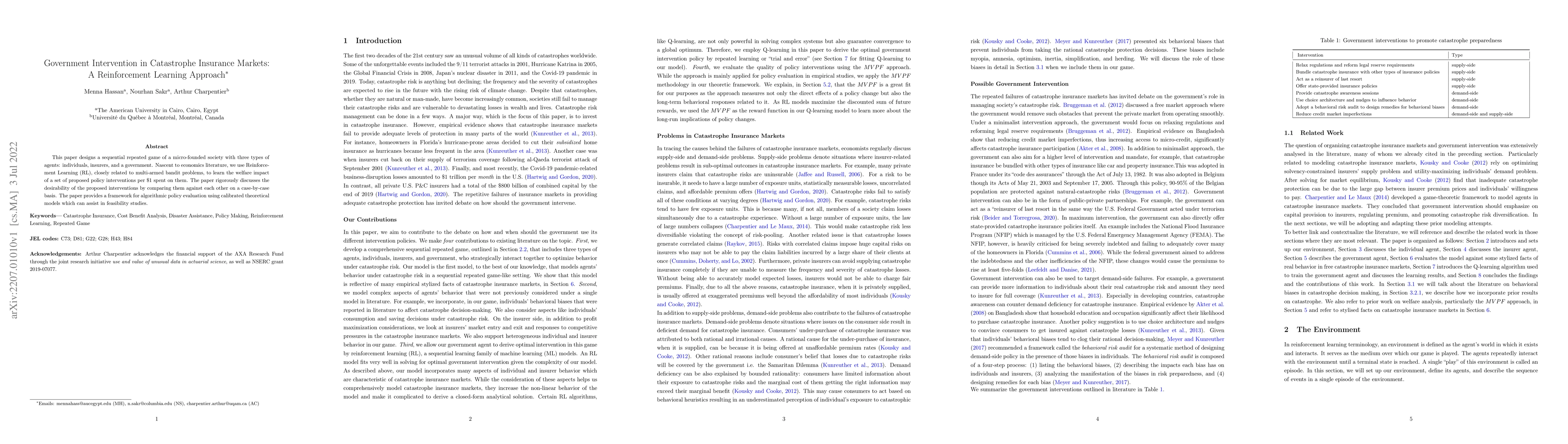

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCatastrophe Insurance: An Adaptive Robust Optimization Approach

Dimitris Bertsimas, Cynthia Zeng

Optimal Monotone Mean-Variance Problem in a Catastrophe Insurance Model

Bohan Li, Xiaoqing Liang, Junyi Guo

No citations found for this paper.

Comments (0)