Summary

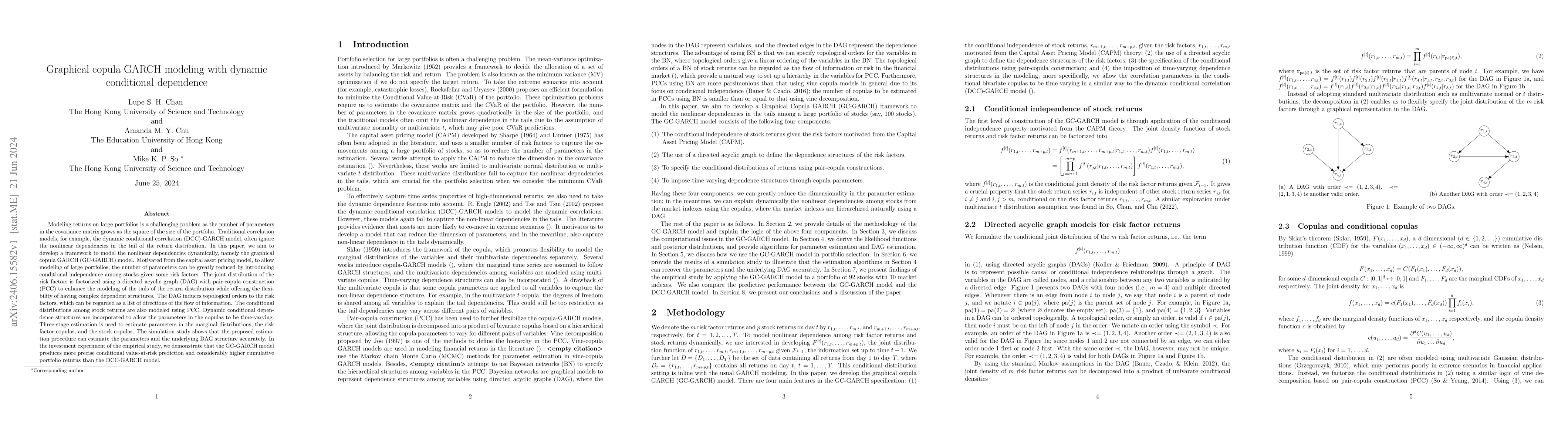

Modeling returns on large portfolios is a challenging problem as the number of parameters in the covariance matrix grows as the square of the size of the portfolio. Traditional correlation models, for example, the dynamic conditional correlation (DCC)-GARCH model, often ignore the nonlinear dependencies in the tail of the return distribution. In this paper, we aim to develop a framework to model the nonlinear dependencies dynamically, namely the graphical copula GARCH (GC-GARCH) model. Motivated from the capital asset pricing model, to allow modeling of large portfolios, the number of parameters can be greatly reduced by introducing conditional independence among stocks given some risk factors. The joint distribution of the risk factors is factorized using a directed acyclic graph (DAG) with pair-copula construction (PCC) to enhance the modeling of the tails of the return distribution while offering the flexibility of having complex dependent structures. The DAG induces topological orders to the risk factors, which can be regarded as a list of directions of the flow of information. The conditional distributions among stock returns are also modeled using PCC. Dynamic conditional dependence structures are incorporated to allow the parameters in the copulas to be time-varying. Three-stage estimation is used to estimate parameters in the marginal distributions, the risk factor copulas, and the stock copulas. The simulation study shows that the proposed estimation procedure can estimate the parameters and the underlying DAG structure accurately. In the investment experiment of the empirical study, we demonstrate that the GC-GARCH model produces more precise conditional value-at-risk prediction and considerably higher cumulative portfolio returns than the DCC-GARCH model.

AI Key Findings

Generated Sep 03, 2025

Methodology

The paper proposes a Graphical Copula GARCH (GC-GARCH) model that reduces the number of correlation parameters using the CAPM theory, factorizing risk factors (market indexes) to explain co-movements in a portfolio of stocks. It captures tail dependencies among risk factors and stock returns using pair-copula construction, with risk factors represented as a Bayesian network allowing ranking of stocks by topological orders.

Key Results

- The proposed three-stage estimation procedure accurately estimates parameters in marginal distributions, DAG copulas, and stock copulas.

- Simulation studies demonstrate that the estimation procedure can accurately estimate parameters and underlying DAG structure.

- The empirical study shows that the GC-GARCH model produces more precise conditional Value-at-Risk (CVaR) predictions and considerably higher cumulative portfolio returns compared to the DCC-GARCH model.

- The moving-window investment experiment indicates that the GC-GARCH model outperforms the traditional DCC-GARCH model in covering extreme losses, avoiding risk, and making profits from market investments.

- The GC-GARCH model with model averaging further improves performance over the MAP network-based GC-GARCH model.

Significance

This research is significant as it presents a more efficient method for modeling large portfolios by reducing the number of parameters in the covariance matrix, which is crucial for handling the computational challenges associated with high-dimensional data. The proposed GC-GARCH model captures nonlinear dependencies in the tail of return distributions, offering a more accurate representation of financial time series data, which is essential for risk management and portfolio optimization.

Technical Contribution

The paper introduces the Graphical Copula GARCH (GC-GARCH) model, which integrates pair-copula constructions with a Bayesian network to model dynamic conditional dependence structures in financial time series data, offering a more efficient and accurate approach to modeling large portfolios.

Novelty

The novelty of this work lies in its combination of the GARCH model with graphical copulas and Bayesian networks, allowing for a more parsimonious representation of high-dimensional financial data while capturing complex tail dependencies, which distinguishes it from traditional correlation models like the DCC-GARCH.

Limitations

- The paper assumes a fixed underlying network in the GC-GARCH model, which may not reflect the dynamic nature of financial markets.

- The study uses the t-copula, which assumes elliptical distributions, potentially neglecting asymmetric tail dependence in financial returns.

Future Work

- Investigate dynamic structures for the underlying network in the GC-GARCH model to better capture the evolving nature of financial markets.

- Explore alternative copula families, such as Gumbel or Clayton copulas, to better model asymmetric tail dependence in financial returns.

Paper Details

PDF Preview

Key Terms

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)