Authors

Summary

This paper proposes a new one-sided matching market model in which every agent has a cost function that is allowed to take a negative value. Our model aims to capture the situation where some agents can profit by exchanging their obtained goods with other agents. We formulate such a model based on a graphical one-sided matching market, introduced by Massand and Simon [Massand and Simon, IJCAI 2019]. We investigate the existence of stable outcomes for such a market. We prove that there is an instance that has no core-stable allocation. On the other hand, we guarantee the existence of two-stable allocations even where exchange costs exist. However, it is PLS-hard to find a two-stable allocation for a market with exchange costs even if the maximum degree of the graph is five.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

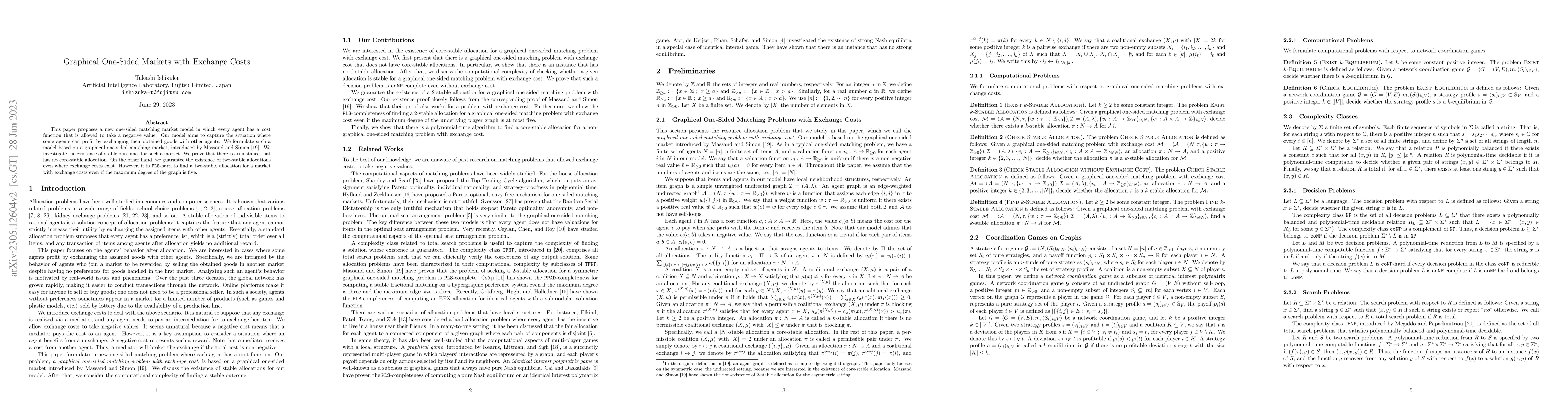

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTwo for One $\&$ One for All: Two-Sided Manipulation in Matching Markets

Hadi Hosseini, Rohit Vaish, Fatima Umar

No citations found for this paper.

Comments (0)