Authors

Summary

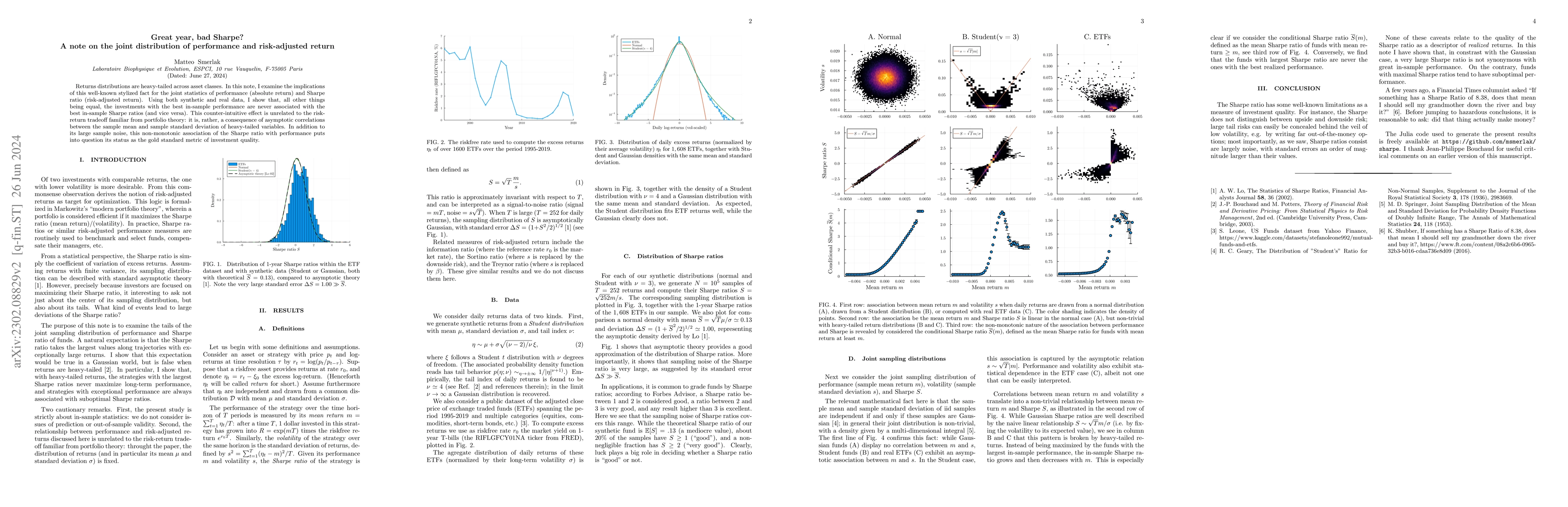

Returns distributions are heavy-tailed across asset classes. In this note, I examine the implications of this well-known stylized fact for the joint statistics of performance (absolute return) and Sharpe ratio (risk-adjusted return). Using both synthetic and real data, I show that, all other things being equal, the investments with the best in-sample performance are never associated with the best in-sample Sharpe ratios (and vice versa). This counter-intuitive effect is unrelated to the risk-return tradeoff familiar from portfolio theory: it is, rather, a consequence of asymptotic correlations between the sample mean and sample standard deviation of heavy-tailed variables. In addition to its large sample noise, this non-monotonic association of the Sharpe ratio with performance puts into question its status as the gold standard metric of investment quality.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)