Summary

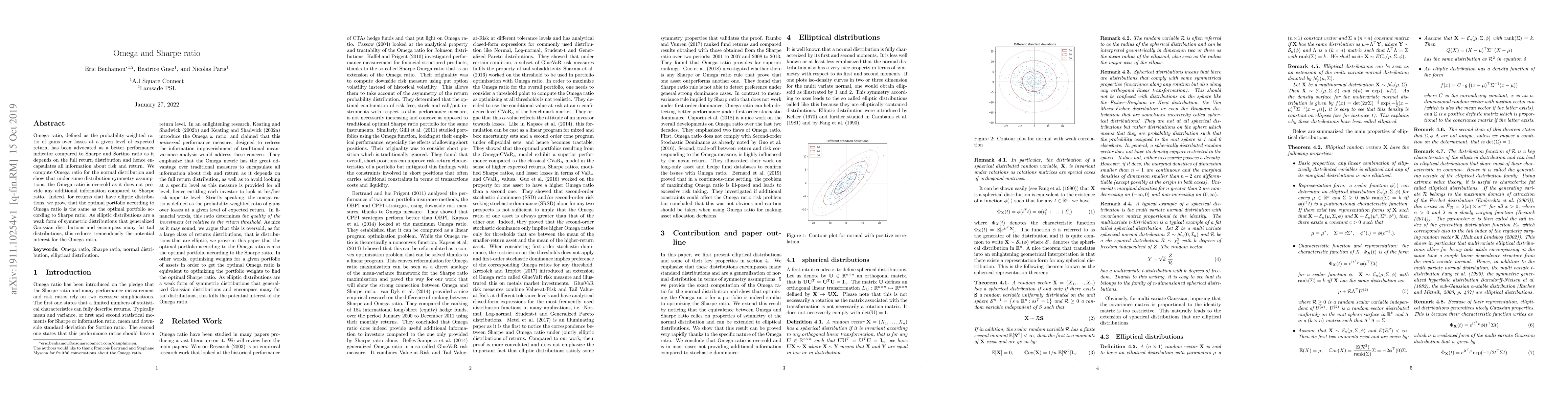

Omega ratio, defined as the probability-weighted ratio of gains over losses at a given level of expected return, has been advocated as a better performance indicator compared to Sharpe and Sortino ratio as it depends on the full return distribution and hence encapsulates all information about risk and return. We compute Omega ratio for the normal distribution and show that under some distribution symmetry assumptions, the Omega ratio is oversold as it does not provide any additional information compared to Sharpe ratio. Indeed, for returns that have elliptic distributions, we prove that the optimal portfolio according to Omega ratio is the same as the optimal portfolio according to Sharpe ratio. As elliptic distributions are a weak form of symmetric distributions that generalized Gaussian distributions and encompass many fat tail distributions, this reduces tremendously the potential interest for the Omega ratio.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)