Authors

Summary

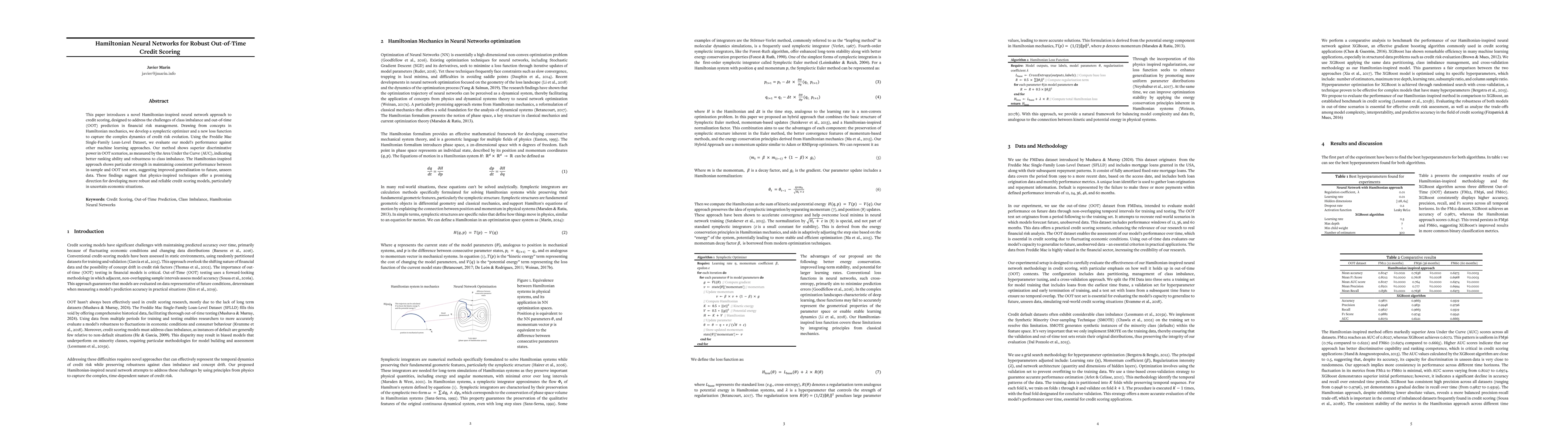

This paper introduces a novel Hamiltonian-inspired neural network approach to credit scoring, designed to address the challenges of class imbalance and out-of-time (OOT) prediction in financial risk management. Drawing from concepts in Hamiltonian mechanics, we develop a symplectic optimizer and a new loss function to capture the complex dynamics of credit risk evolution. Using the Freddie Mac Single-Family Loan-Level Dataset, we evaluate our model's performance against other machine learning approaches. Our method shows superior discriminative power in OOT scenarios, as measured by the Area Under the Curve (AUC), indicating better ranking ability and robustness to class imbalance. The Hamiltonian-inspired approach shows particular strength in maintaining consistent performance between in-sample and OOT test sets, suggesting improved generalization to future, unseen data. These findings suggest that physics-inspired techniques offer a promising direction for developing more robust and reliable credit scoring models, particularly in uncertain economic situations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Distributionally Robust Optimisation Approach to Fair Credit Scoring

Christophe Mues, Huan Yu, Pablo Casas

Monotonic Neural Additive Models: Pursuing Regulated Machine Learning Models for Credit Scoring

Dangxing Chen, Weicheng Ye

No citations found for this paper.

Comments (0)