Authors

Summary

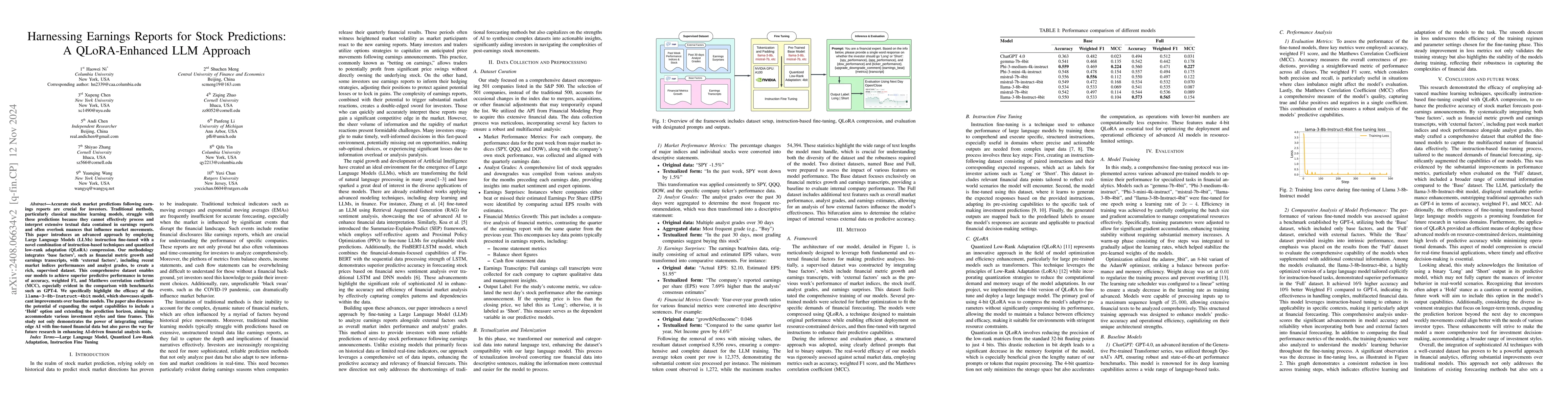

Accurate stock market predictions following earnings reports are crucial for investors. Traditional methods, particularly classical machine learning models, struggle with these predictions because they cannot effectively process and interpret extensive textual data contained in earnings reports and often overlook nuances that influence market movements. This paper introduces an advanced approach by employing Large Language Models (LLMs) instruction fine-tuned with a novel combination of instruction-based techniques and quantized low-rank adaptation (QLoRA) compression. Our methodology integrates 'base factors', such as financial metric growth and earnings transcripts, with 'external factors', including recent market indices performances and analyst grades, to create a rich, supervised dataset. This comprehensive dataset enables our models to achieve superior predictive performance in terms of accuracy, weighted F1, and Matthews correlation coefficient (MCC), especially evident in the comparison with benchmarks such as GPT-4. We specifically highlight the efficacy of the llama-3-8b-Instruct-4bit model, which showcases significant improvements over baseline models. The paper also discusses the potential of expanding the output capabilities to include a 'Hold' option and extending the prediction horizon, aiming to accommodate various investment styles and time frames. This study not only demonstrates the power of integrating cutting-edge AI with fine-tuned financial data but also paves the way for future research in enhancing AI-driven financial analysis tools.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAn Exploratory Study of Stock Price Movements from Earnings Calls

Yang Yang, Sourav Medya, Brian Uzzi et al.

MiMIC: Multi-Modal Indian Earnings Calls Dataset to Predict Stock Prices

Sudip Kumar Naskar, Sohom Ghosh, Arnab Maji

| Title | Authors | Year | Actions |

|---|

Comments (0)