Summary

We study the tails of closing auction return distributions for a sample of liquid European stocks. We use the stochastic call auction model of Derksen et al. (2020a), to derive a relation between tail exponents of limit order placement distributions and tail exponents of the resulting closing auction return distribution and we verify this relation empirically. Counter-intuitively, large closing price fluctuations are typically not caused by large market orders, instead tails become heavier when market orders are removed. The model explains this by the observation that limit orders are submitted so as to counter existing market order imbalance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

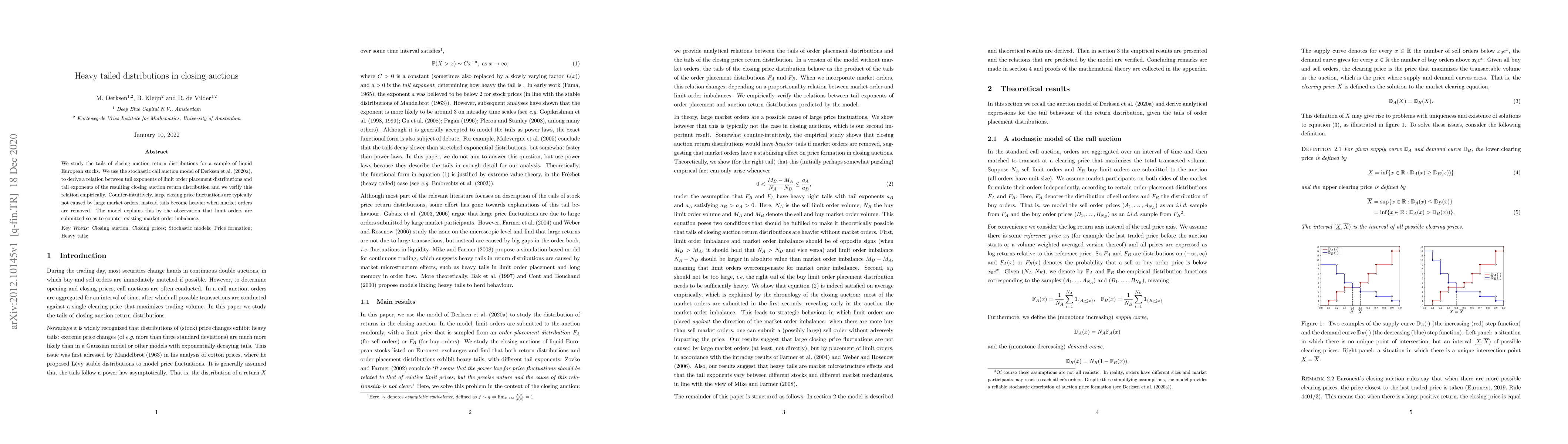

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHeavy-tailed probability distributions in social sciences

Lev B. Klebanov, Yulia V. Kuvaeva

| Title | Authors | Year | Actions |

|---|

Comments (0)