Summary

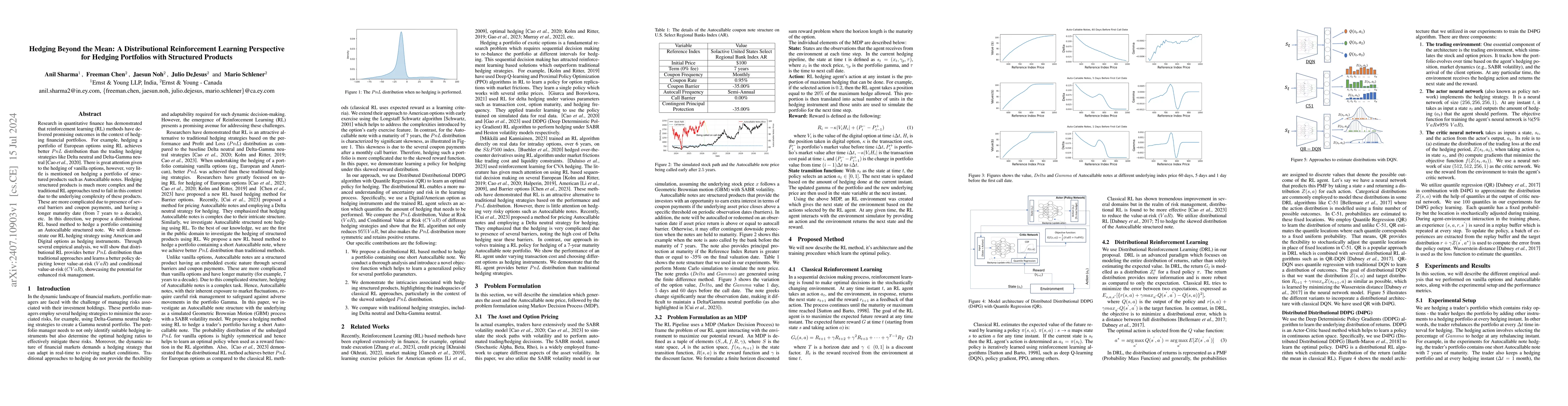

Research in quantitative finance has demonstrated that reinforcement learning (RL) methods have delivered promising outcomes in the context of hedging financial portfolios. For example, hedging a portfolio of European options using RL achieves better $PnL$ distribution than the trading hedging strategies like Delta neutral and Delta-Gamma neutral [Cao et. al. 2020]. There is great attention given to the hedging of vanilla options, however, very little is mentioned on hedging a portfolio of structured products such as Autocallable notes. Hedging structured products is much more complex and the traditional RL approaches tend to fail in this context due to the underlying complexity of these products. These are more complicated due to presence of several barriers and coupon payments, and having a longer maturity date (from $7$ years to a decade), etc. In this direction, we propose a distributional RL based method to hedge a portfolio containing an Autocallable structured note. We will demonstrate our RL hedging strategy using American and Digital options as hedging instruments. Through several empirical analysis, we will show that distributional RL provides better $PnL$ distribution than traditional approaches and learns a better policy depicting lower value-at-risk ($VaR$) and conditional value-at-risk ($CVaR$), showcasing the potential for enhanced risk management.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep Hedging: Continuous Reinforcement Learning for Hedging of General Portfolios across Multiple Risk Aversions

Hans Buehler, Phillip Murray, Ben Wood et al.

Hedging and Pricing Structured Products Featuring Multiple Underlying Assets

Anil Sharma, Freeman Chen, Jaesun Noh et al.

Adaptive Nesterov Accelerated Distributional Deep Hedging for Efficient Volatility Risk Management

Lei Zhao, Lin Cai, Wu-Sheng Lu

EX-DRL: Hedging Against Heavy Losses with EXtreme Distributional Reinforcement Learning

Zeyu Wang, Parvin Malekzadeh, Konstantinos N. Plataniotis et al.

No citations found for this paper.

Comments (0)