Authors

Summary

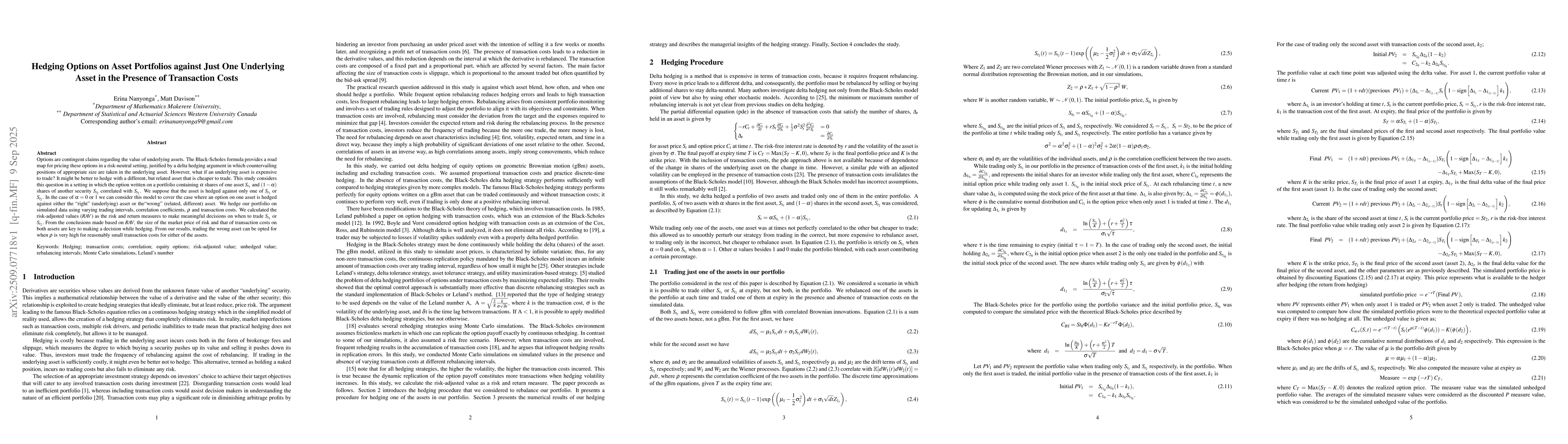

Options are contingent claims regarding the value of underlying assets. The Black-Scholes formula provides a road map for pricing these options in a risk-neutral setting, justified by a delta hedging argument in which countervailing positions of appropriate size are taken in the underlying asset. However, what if an underlying asset is expensive to trade? It might be better to hedge with a different, but related asset that is cheaper to trade. This study considers this question in a setting in which the option written on a portfolio containing $\alpha$ shares of one asset $S_{t_1}$ and $(1-\alpha)$ shares of another security $S_{t_2}$ correlated with $S_{t_1}$. We suppose that the asset is hedged against only one of $S_{t_1}$ or $S_{t_2}.$ In the case of $\alpha=0~\text{or}~1$ we can consider this model to cover the case where an option on one asset is hedged against either the ``right" (underlying) asset or the``wrong" (related, different) asset. We hedge our portfolio on simulated data using varying trading intervals, correlation coefficients, $\rho$ and transaction costs. We calculated the risk-adjusted values ($RAV$) as the risk and return measures to make meaningful decisions on when to trade $S_{t_1}$ or $S_{t_2}.$ From the conclusions made based on $RAV,$ the size of the market price of risk and that of transaction costs on both assets are key to making a decision while hedging. From our results, trading the wrong asset can be opted for when $\rho$ is very high for reasonably small transaction costs for either of the assets.

AI Key Findings

Generated Nov 02, 2025

Methodology

The research employs delta hedging strategies on a portfolio of two assets with transaction costs, analyzing the impact of varying transaction costs and correlation coefficients on hedging decisions using risk-adjusted value (RAV) metrics.

Key Results

- Trading the right asset is optimal when transaction costs are low and correlation is high

- High transaction costs make no hedging the best strategy

- RAV analysis provides better decision-making than variance alone

Significance

This study offers practical insights for investors and portfolio managers on optimal hedging strategies under transaction costs, enhancing risk-adjusted returns.

Technical Contribution

Develops a framework for evaluating hedging strategies with transaction costs using RAV metrics

Novelty

Integrates transaction cost analysis with correlation effects in hedging decisions, providing a more comprehensive risk assessment framework

Limitations

- Results depend on specific parameter assumptions

- Limited to two-asset portfolios

Future Work

- Extending to multi-asset portfolios

- Incorporating more complex risk measures

Comments (0)