Summary

We study neural networks as nonparametric estimation tools for the hedging of options. To this end, we design a network, named HedgeNet, that directly outputs a hedging strategy. This network is trained to minimise the hedging error instead of the pricing error. Applied to end-of-day and tick prices of S&P 500 and Euro Stoxx 50 options, the network is able to reduce the mean squared hedging error of the Black-Scholes benchmark significantly. However, a similar benefit arises by simple linear regressions that incorporate the leverage effect.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersIdentifying key differences between linear stochastic estimation and neural networks for fluid flow regressions

Kai Fukami, Taichi Nakamura, Koji Fukagata

Chaotic Hedging with Iterated Integrals and Neural Networks

Ariel Neufeld, Philipp Schmocker

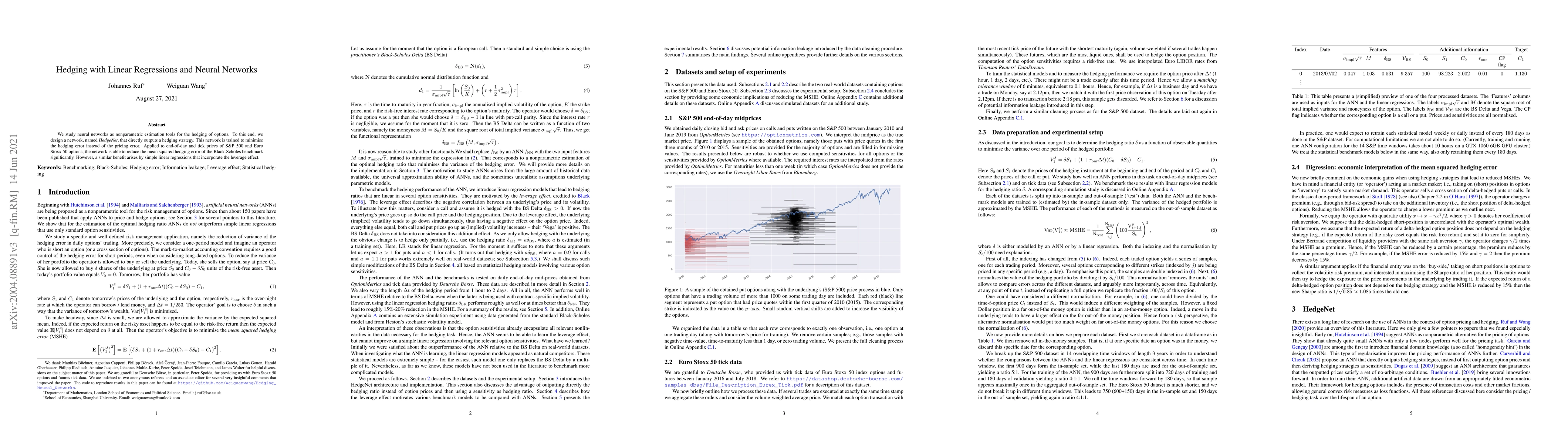

| Title | Authors | Year | Actions |

|---|

Comments (0)