Summary

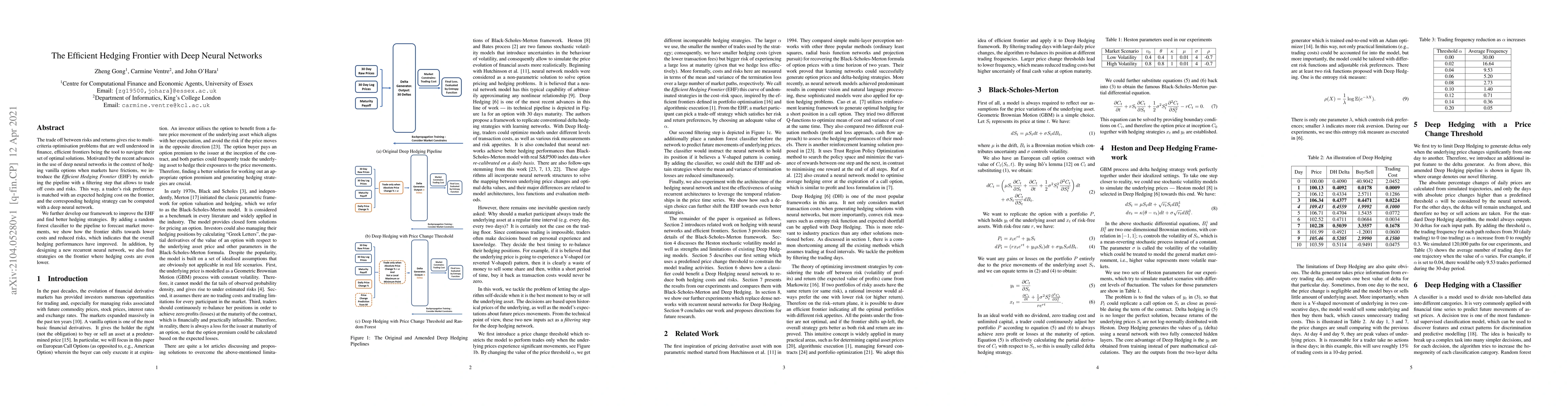

The trade off between risks and returns gives rise to multi-criteria optimisation problems that are well understood in finance, efficient frontiers being the tool to navigate their set of optimal solutions. Motivated by the recent advances in the use of deep neural networks in the context of hedging vanilla options when markets have frictions, we introduce the Efficient Hedging Frontier (EHF) by enriching the pipeline with a filtering step that allows to trade off costs and risks. This way, a trader's risk preference is matched with an expected hedging cost on the frontier, and the corresponding hedging strategy can be computed with a deep neural network. We further develop our framework to improve the EHF and find better hedging strategies. By adding a random forest classifier to the pipeline to forecast market movements, we show how the frontier shifts towards lower costs and reduced risks, which indicates that the overall hedging performances have improved. In addition, by designing a new recurrent neural network, we also find strategies on the frontier where hedging costs are even lower.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEfficient Learning of Nested Deep Hedging using Multiple Options

Masanori Hirano, Kentaro Imajo, Kentaro Minami et al.

No citations found for this paper.

Comments (0)