Authors

Summary

We solve the superhedging problem for European options in an illiquid extension of the Black-Scholes model, in which transactions have transient price impact and the costs and the strategies for hedging are affected by physical or cash settlement requirements at maturity. Our analysis is based on a convenient choice of reduced effective coordinates of magnitudes at liquidation for geometric dynamic programming. The price impact is transient over time and multiplicative, ensuring non-negativity of underlying asset prices while maintaining an arbitrage-free model. The basic (log-)linear example is a Black-Scholes model with relative price impact being proportional to the volume of shares traded, where the transience for impact on log-prices is being modelled like in Obizhaeva-Wang \cite{ObizhaevaWang13} for nominal prices. More generally, we allow for non-linear price impact and resilience functions. The viscosity solutions describing the minimal superhedging price are governed by the transient character of the price impact and by the physical or cash settlement specifications. Pricing equations under illiquidity extend no-arbitrage pricing a la Black-Scholes for complete markets in a non-paradoxical way (cf.\ {\c{C}}etin, Soner and Touzi \cite{CetinSonerTouzi10}) even without additional frictions, and can recover it in base cases.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

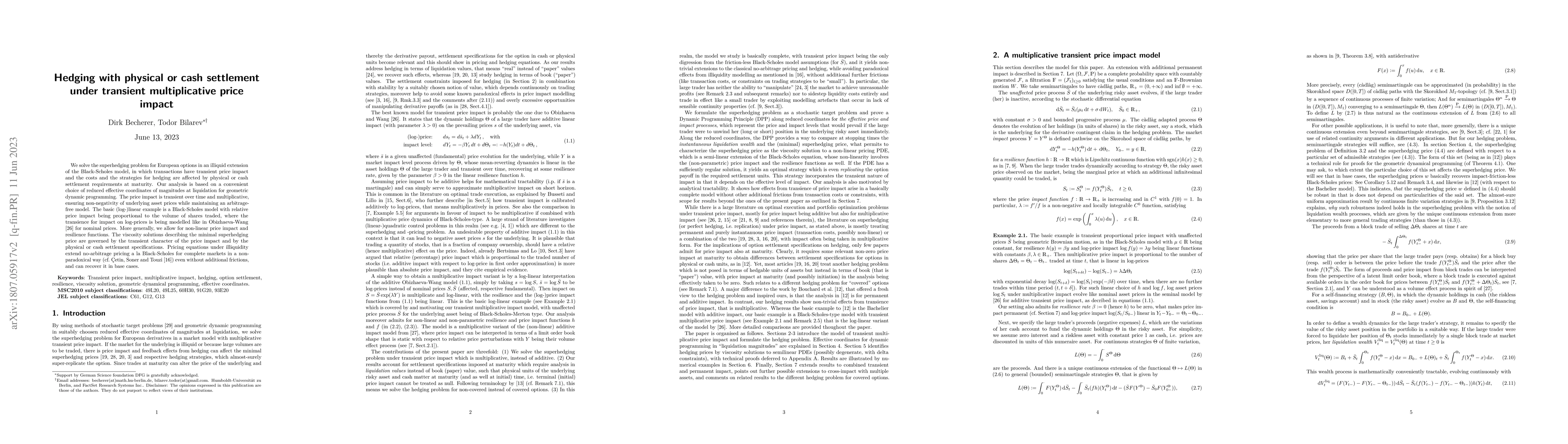

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)