Summary

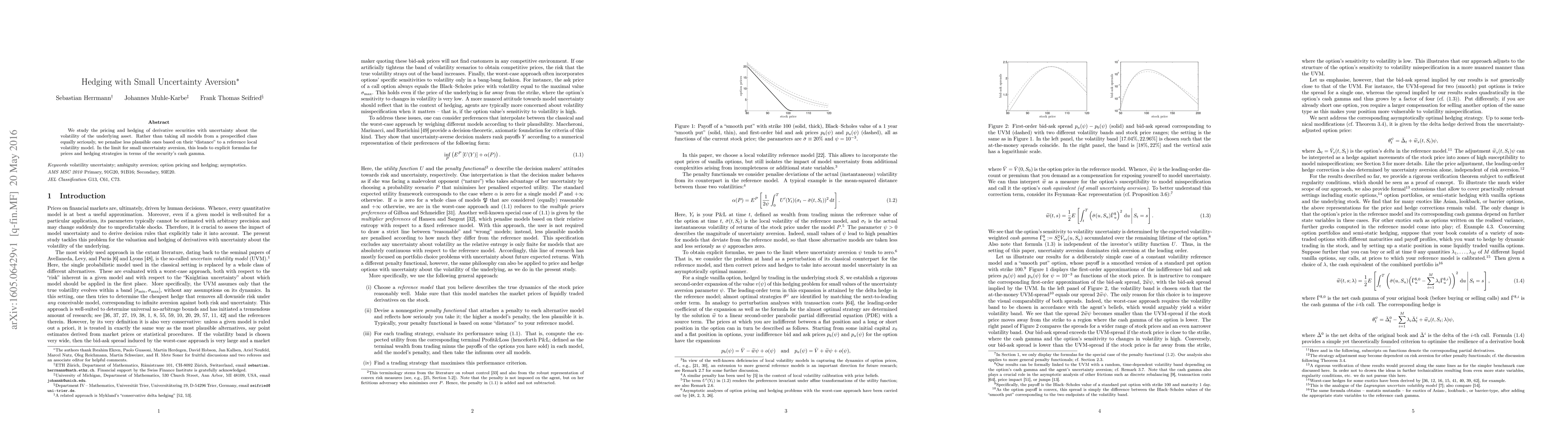

We study the pricing and hedging of derivative securities with uncertainty about the volatility of the underlying asset. Rather than taking all models from a prespecified class equally seriously, we penalise less plausible ones based on their "distance" to a reference local volatility model. In the limit for small uncertainty aversion, this leads to explicit formulas for prices and hedging strategies in terms of the security's cash gamma.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)