Summary

In this paper, we study the optimal investment problem involving two agents, where the decision of one agent is influenced by the other. To measure the distance between two agents' decisions, we introduce the average deviation. We formulate the stochastic optimal control problem considering herd behavior and derive the analytical solution through the variational method. We theoretically analyze the impact of users' herd behavior on the optimal decision by decomposing it into their rational decisions, which is called the rational decision decomposition. Furthermore, to quantify the preference for their rational decision over that of the other agent, we introduce the agent's investment opinion. Our study is validated through simulations on real stock data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

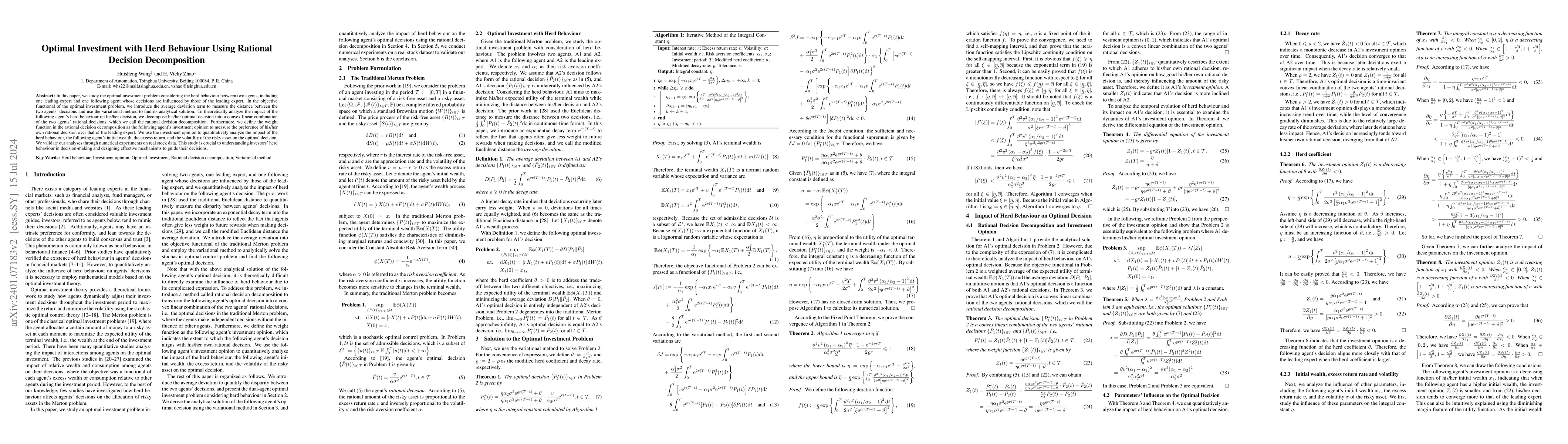

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal Investment under the Influence of Decision-changing Imitation

Huisheng Wang, H. Vicky Zhao

InvestAlign: Overcoming Data Scarcity in Aligning Large Language Models with Investor Decision-Making Processes under Herd Behavior

Huisheng Wang, Zhuoshi Pan, H. Vicky Zhao et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)