Authors

Summary

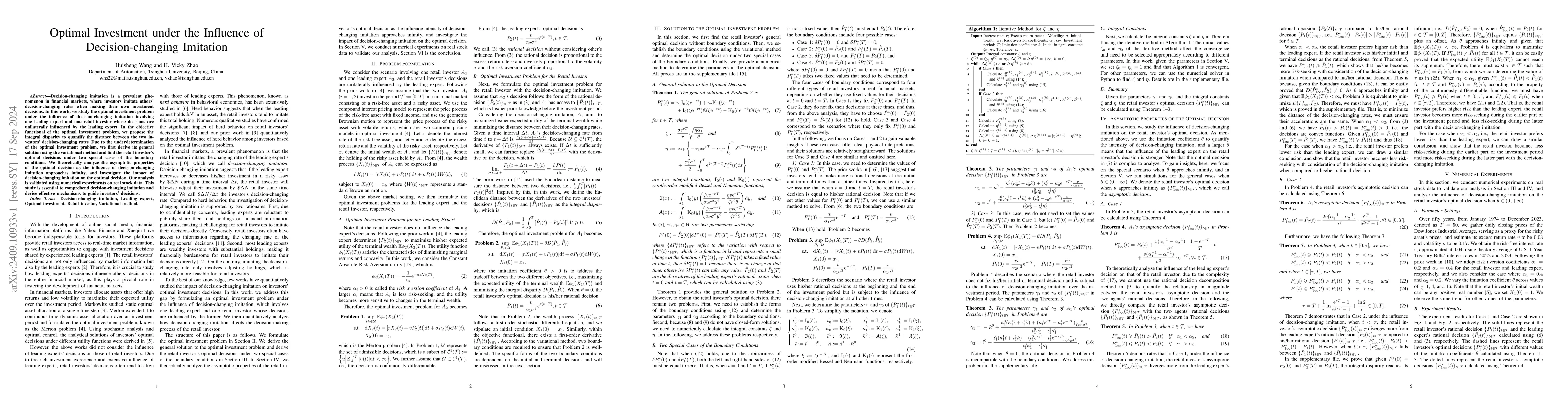

Decision-changing imitation is a prevalent phenomenon in financial markets, where investors imitate others' decision-changing rates when making their own investment decisions. In this work, we study the optimal investment problem under the influence of decision-changing imitation involving one leading expert and one retail investor whose decisions are unilaterally influenced by the leading expert. In the objective functional of the optimal investment problem, we propose the integral disparity to quantify the distance between the two investors' decision-changing rates. Due to the underdetermination of the optimal investment problem, we first derive its general solution using the variational method and find the retail investor's optimal decisions under two special cases of the boundary conditions. We theoretically analyze the asymptotic properties of the optimal decision as the influence of decision-changing imitation approaches infinity, and investigate the impact of decision-changing imitation on the optimal decision. Our analysis is validated using numerical experiments on real stock data. This study is essential to comprehend decision-changing imitation and devise effective mechanisms to guide investors' decisions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal Investment under Mutual Strategy Influence among Agents

Huisheng Wang, H. Vicky Zhao

Optimal Policy Design for Repeated Decision-Making under Social Influence

Fabrizio Dabbene, Valentina Breschi, Chiara Ravazzi et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)