Authors

Summary

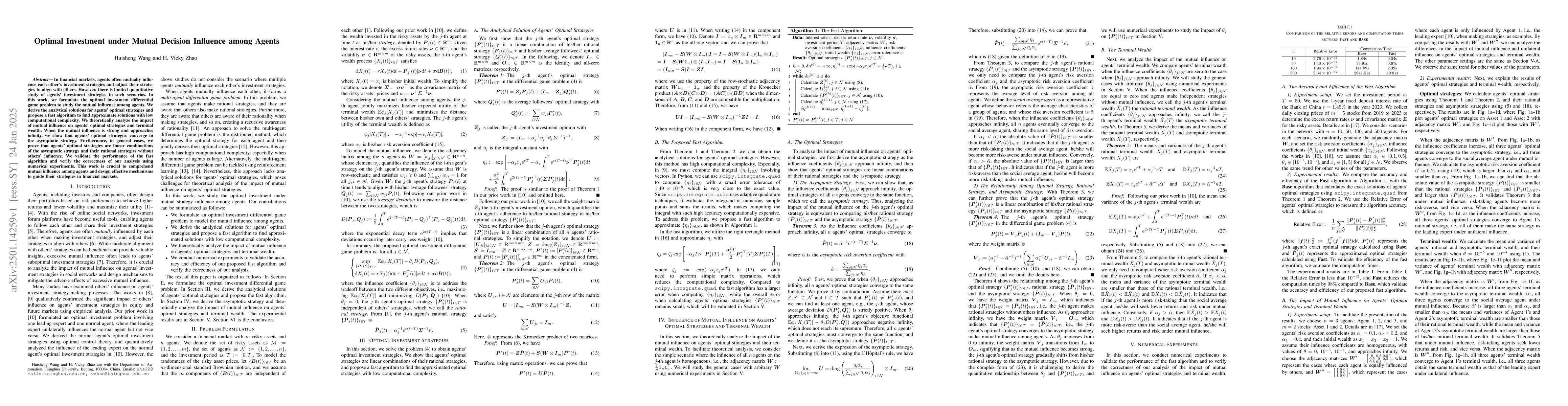

In financial markets, agents often mutually influence each other's investment strategies and adjust their strategies to align with others. However, there is limited quantitative study of agents' investment strategies in such scenarios. In this work, we formulate the optimal investment differential game problem to study the mutual influence among agents. We derive the analytical solutions for agents' optimal strategies and propose a fast algorithm to find approximate solutions with low computational complexity. We theoretically analyze the impact of mutual influence on agents' optimal strategies and terminal wealth. When the mutual influence is strong and approaches infinity, we show that agents' optimal strategies converge to the asymptotic strategy. Furthermore, in general cases, we prove that agents' optimal strategies are linear combinations of the asymptotic strategy and their rational strategies without others' influence. We validate the performance of the fast algorithm and verify the correctness of our analysis using numerical experiments. This work is crucial to comprehend mutual influence among agents and design effective mechanisms to guide their strategies in financial markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersOptimal Investment under the Influence of Decision-changing Imitation

Huisheng Wang, H. Vicky Zhao

No citations found for this paper.

Comments (0)