Summary

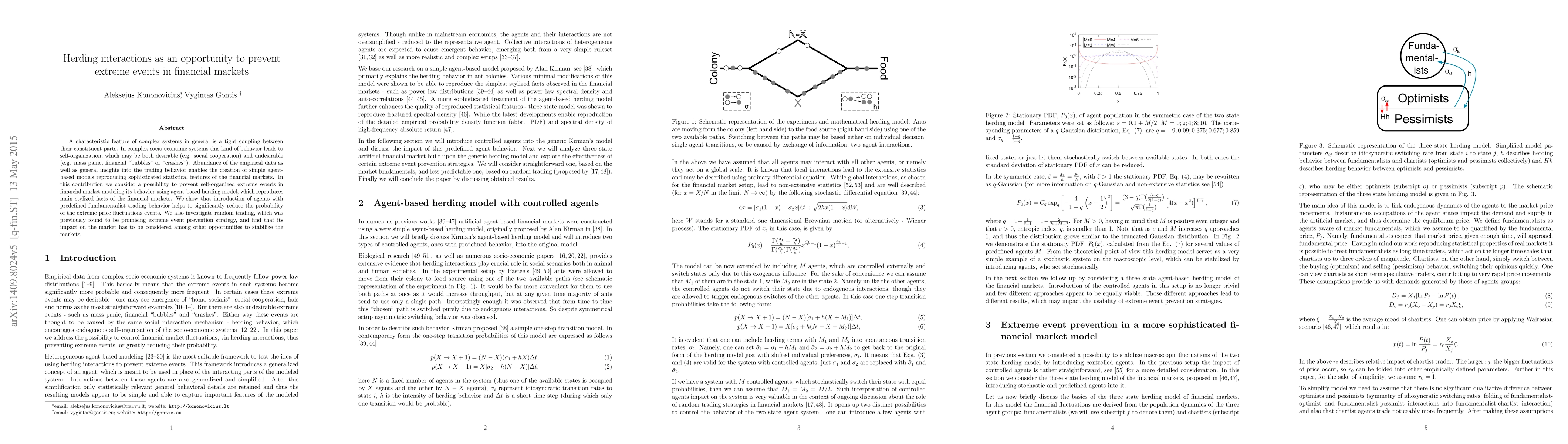

A characteristic feature of complex systems in general is a tight coupling between their constituent parts. In complex socio-economic systems this kind of behavior leads to self-organization, which may be both desirable (e.g. social cooperation) and undesirable (e.g. mass panic, financial "bubbles" or "crashes"). Abundance of the empirical data as well as general insights into the trading behavior enables the creation of simple agent-based models reproducing sophisticated statistical features of the financial markets. In this contribution we consider a possibility to prevent self-organized extreme events in artificial financial market setup built upon a simple agent-based herding model. We show that introduction of agents with predefined fundamentalist trading behavior helps to significantly reduce the probability of the extreme price fluctuations events. We also test random trading control strategy, which was previously found to be promising, and find that its impact on the market is rather ambiguous. Though some of the results indicate that it might actually stabilize financial fluctuations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)