Summary

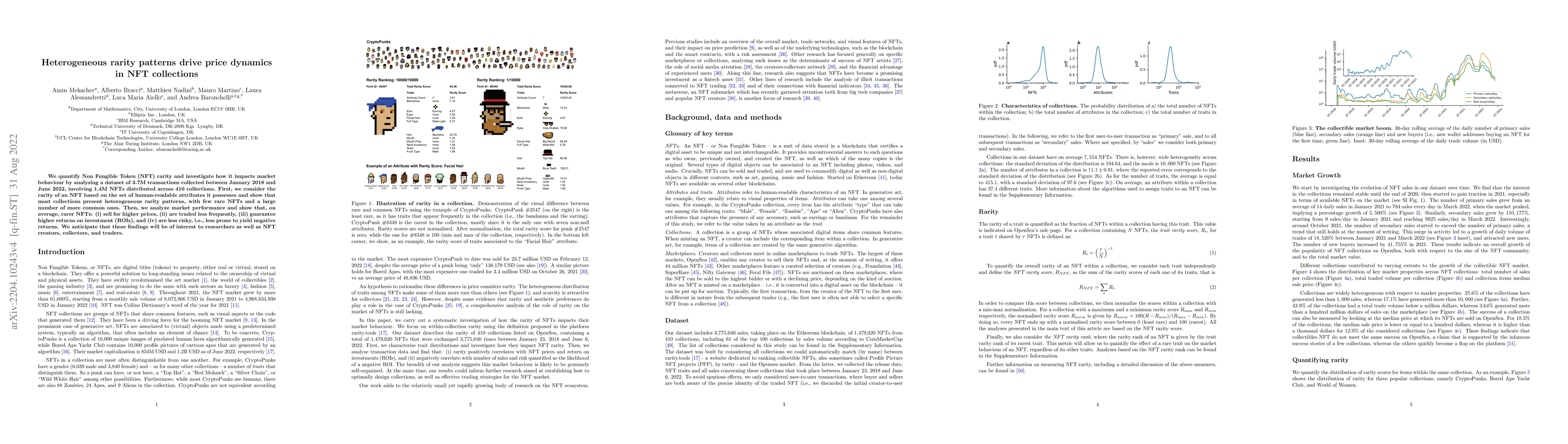

We quantify Non Fungible Token (NFT) rarity and investigate how it impacts market behaviour by analysing a dataset of 3.7M transactions collected between January 2018 and June 2022, involving 1.4M NFTs distributed across 410 collections. First, we consider the rarity of an NFT based on the set of human-readable attributes it possesses and show that most collections present heterogeneous rarity patterns, with few rare NFTs and a large number of more common ones. Then, we analyze market performance and show that, on average, rarer NFTs: (i) sell for higher prices, (ii) are traded less frequently, (iii) guarantee higher returns on investment (ROIs), and (iv) are less risky, i.e., less prone to yield negative returns. We anticipate that these findings will be of interest to researchers as well as NFT creators, collectors, and traders.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersConstructing a NFT Price Index and Applications

Hugo Inzirillo, Hugo Schnoering

COMET: NFT Price Prediction with Wallet Profiling

Qi Zhang, Hui Xiong, Chao Wang et al.

Understanding NFT Price Moves through Tweets Keywords Analysis

Xue Liu, Junliang Luo, Yongzheng Jia

| Title | Authors | Year | Actions |

|---|

Comments (0)