Summary

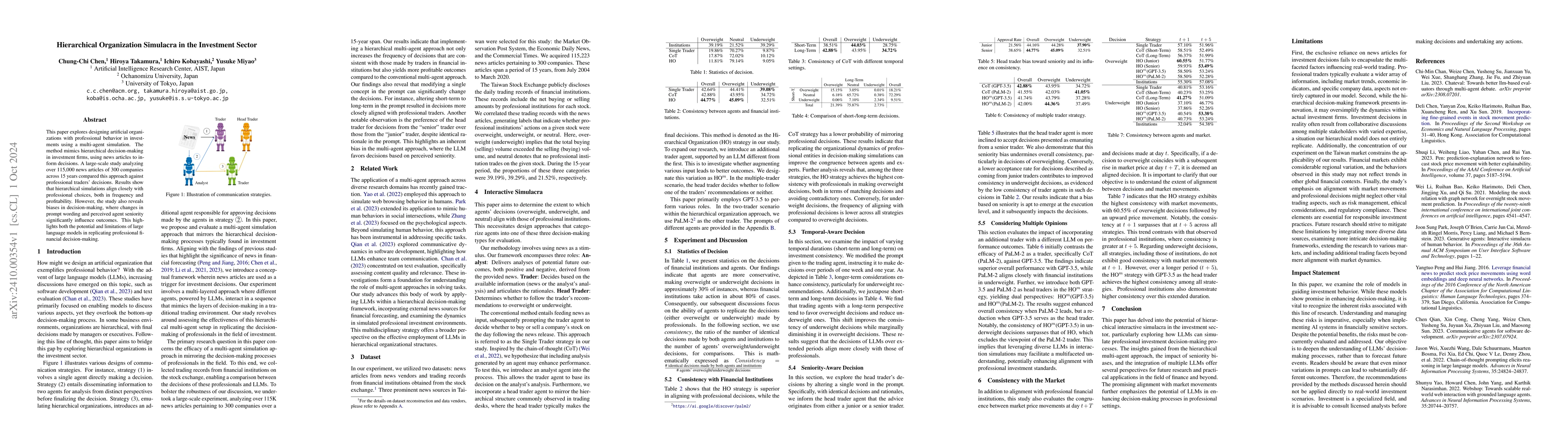

This paper explores designing artificial organizations with professional behavior in investments using a multi-agent simulation. The method mimics hierarchical decision-making in investment firms, using news articles to inform decisions. A large-scale study analyzing over 115,000 news articles of 300 companies across 15 years compared this approach against professional traders' decisions. Results show that hierarchical simulations align closely with professional choices, both in frequency and profitability. However, the study also reveals biases in decision-making, where changes in prompt wording and perceived agent seniority significantly influence outcomes. This highlights both the potential and limitations of large language models in replicating professional financial decision-making.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)