Summary

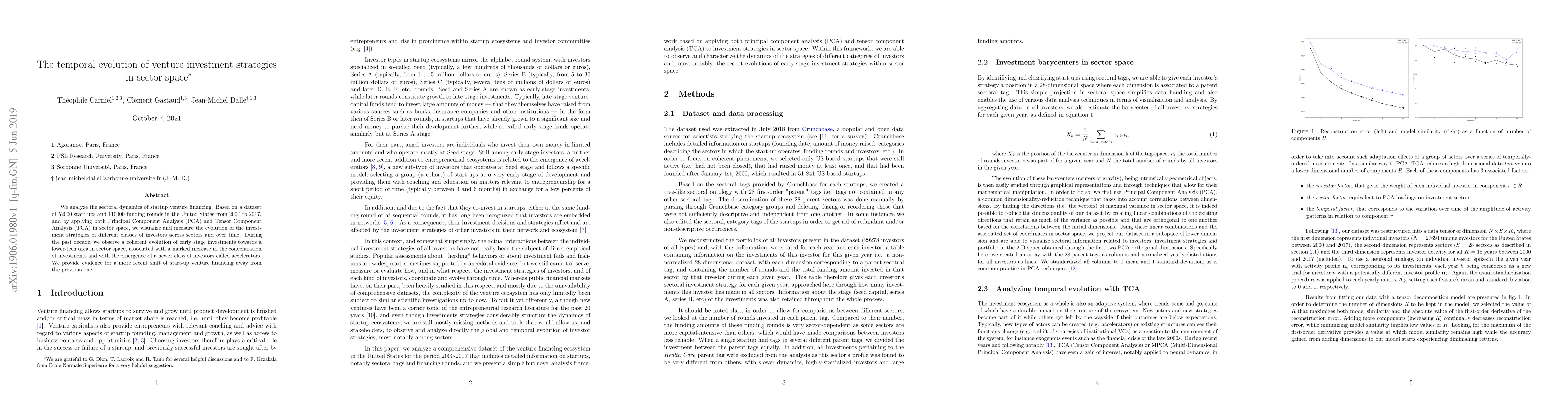

We analyze the sectoral dynamics of startup venture financing. Based on a dataset of 52000 start-ups and 110000 funding rounds in the United States from 2000 to 2017, and by applying both Principal Component Analysis (PCA) and Tensor Component Analysis (TCA) in sector space, we visualize and measure the evolution of the investment strategies of different classes of investors across sectors and over time. During the past decade, we observe a coherent evolution of early stage investments towards a lower-tech area in sector space, associated with a marked increase in the concentration of investments and with the emergence of a newer class of investors called accelerators. We provide evidence for a more recent shift of start-up venture financing away from the previous one.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe evolution of k-shell in syndication networks reveals financial performance of venture capital institutions

Chen Zhao, Jing Liang, Cheng Cheng et al.

The role of media memorability in facilitating startups' access to venture capital funding

A. Fronzetti Colladon, L. Toschi, S. Torrisi

No citations found for this paper.

Comments (0)