Summary

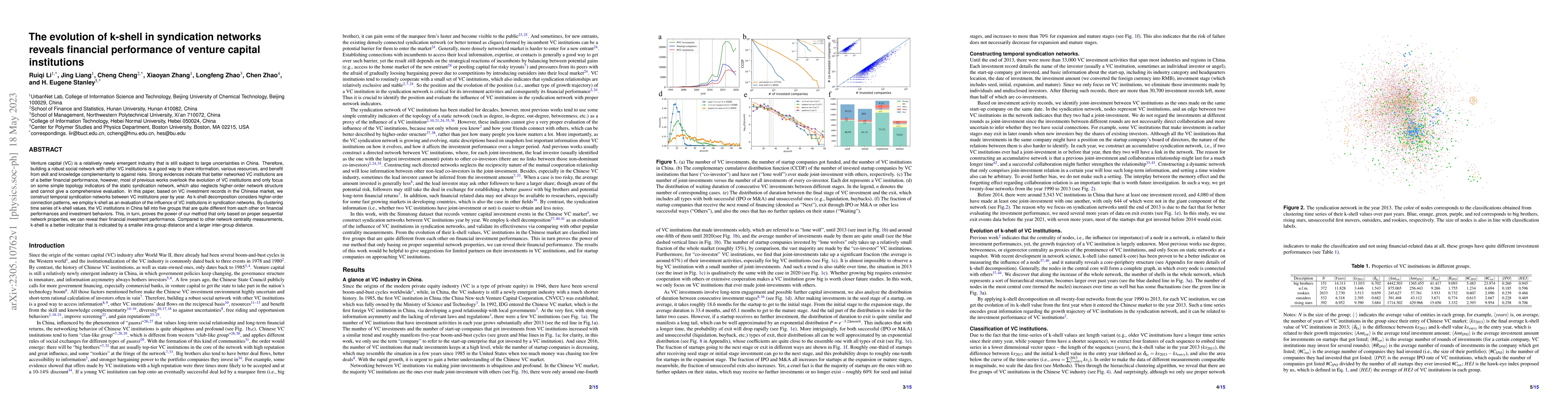

Venture capital (VC) is a relatively newly emergent industry that is still subject to large uncertainties in China. Therefore, building a robust social network with other VC institutions is a good way to share information, various resources, and benefit from skill and knowledge complementarity to against risks. Strong evidences indicate that better networked VC institutions are of a better financial performance, however, most of previous works overlook the evolution of VC institutions and only focus on some simple topology indicators of the static syndication network, which also neglects higher-order network structure and cannot give a comprehensive evaluation. In this paper, based on VC investment records in the Chinese market, we construct temporal syndication networks between VC institutions year by year. As k-shell decomposition considers higher-order connection patterns, we employ k-shell as an evaluation of the influence of VC institutions in syndication networks. By clustering time series of k-shell values, the VC institutions in China fall into five groups that are quite different from each other on financial performances and investment behaviors. This, in turn, proves the power of our method that only based on proper sequential network properties, we can reveal their financial investment performance. Compared to other network centrality measurements, k-shell is a better indicator that is indicated by a smaller intra-group distance and a larger inter-group distance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEffects of syndication network on specialisation and performance of venture capital firms

Jing Liang, Ruiqi Li, Kim Christensen et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)