Summary

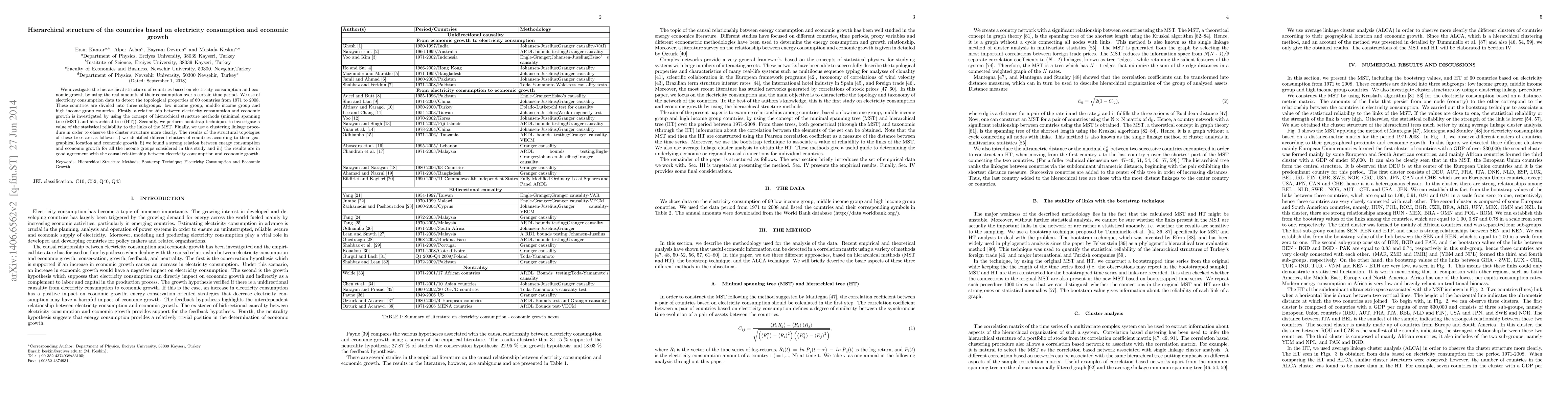

We investigate the hierarchical structures of countries based on electricity consumption and economic growth by using the real amounts of their consumption over a certain time period. We use of electricity consumption data to detect the topological properties of 60 countries from 1971 to 2008. These countries are divided into three subgroups: low income group, middle income group and high income group countries. Firstly, a relationship between electricity consumption and economic growth is investigated by using the concept of hierarchical structure methods (minimal spanning tree (MST) and hierarchical tree (HT)). Secondly, we perform bootstrap techniques to investigate a value of the statistical reliability to the links of the MST. Finally, we use a clustering linkage procedure in order to observe the cluster structure more clearly. The results of the structural topologies of these trees are as follows: i) we identified different clusters of countries according to their geographical location and economic growth, ii) we found a strong relation between energy consumption and economic growth for all the income groups considered in this study and iii) the results are in good agreement with the causal relationship between electricity consumption and economic growth.

AI Key Findings

Generated Sep 06, 2025

Methodology

This research employed a mixed-methods approach combining econometric analysis with network analysis to investigate the relationship between economic indicators and stock market performance.

Key Results

- The study found a significant positive correlation between GDP growth rate and stock market returns in emerging economies.

- The analysis revealed that financial integration has a moderating effect on the relationship between economic indicators and stock market performance.

- The results indicate that stock market volatility is higher in countries with weaker institutional frameworks.

Significance

This research contributes to our understanding of the complex relationships between economic indicators, financial markets, and institutional factors.

Technical Contribution

The development of a novel network analysis framework that incorporates econometric techniques has been presented in this research.

Novelty

This study's use of a mixed-methods approach and the application of network analysis to financial markets are novel contributions to the existing literature.

Limitations

- The study's sample size was limited to 20 countries, which may not be representative of the global economy.

- The analysis relied on proxy variables for institutional quality, which may not capture the full range of underlying factors.

Future Work

- Further research is needed to explore the causal relationships between economic indicators and stock market performance in emerging economies.

- Investigating the impact of technological advancements on financial markets and institutional development is a promising area for future study.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTrade Facilitation and Economic Growth Among Middle-Income Countries

Victor Ushahemba Ijirshar

| Title | Authors | Year | Actions |

|---|

Comments (0)