Summary

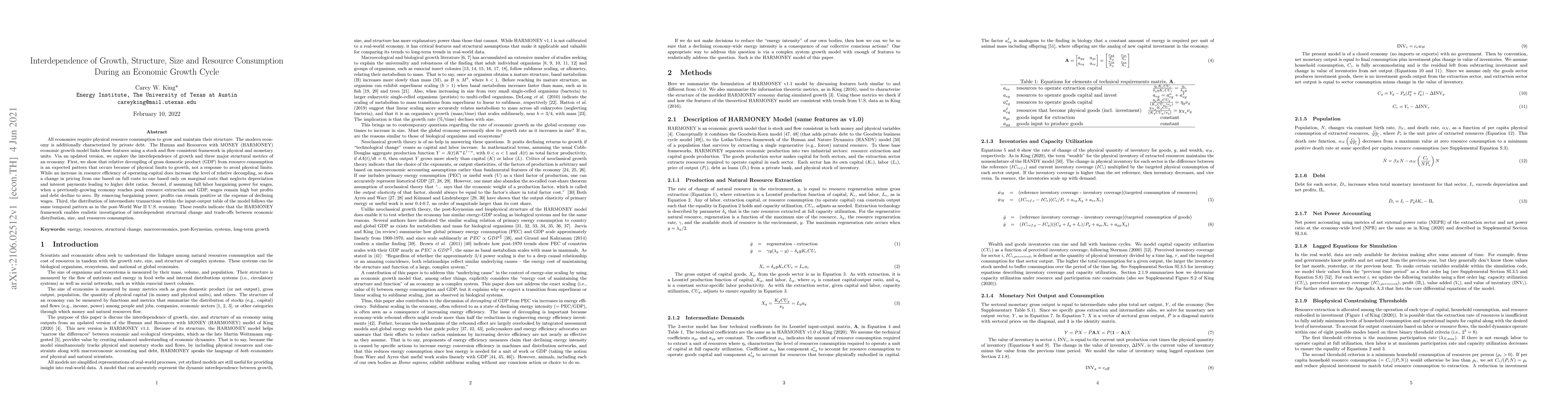

All economies require physical resource consumption to grow and maintain their structure. The modern economy is additionally characterized by private debt. The Human and Resources with MONEY (HARMONEY) economic growth model links these features using a stock and flow consistent framework in physical and monetary units. Via an updated version, we explore the interdependence of growth and three major structural metrics of an economy. First, we show that relative decoupling of gross domestic product (GDP) from resource consumption is an expected pattern that occurs because of physical limits to growth, not a response to avoid physical limits. While an increase in resource efficiency of operating capital does increase the level of relative decoupling, so does a change in pricing from one based on full costs to one based only on marginal costs that neglects depreciation and interest payments leading to higher debt ratios. Second, if assuming full labor bargaining power for wages, when a previously-growing economy reaches peak resource extraction and GDP, wages remain high but profits and debt decline to zero. By removing bargaining power, profits can remain positive at the expense of declining wages. Third, the distribution of intermediate transactions within the input-output table of the model follows the same temporal pattern as in the post-World War II U.S. economy. These results indicate that the HARMONEY framework enables realistic investigation of interdependent structural change and trade-offs between economic distribution, size, and resources consumption.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDynamic Interconnections between Corruption and Economic Growth

Helder Rojas, Kevin Fernandez, Oscar Cutipa-Luque et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)