Authors

Summary

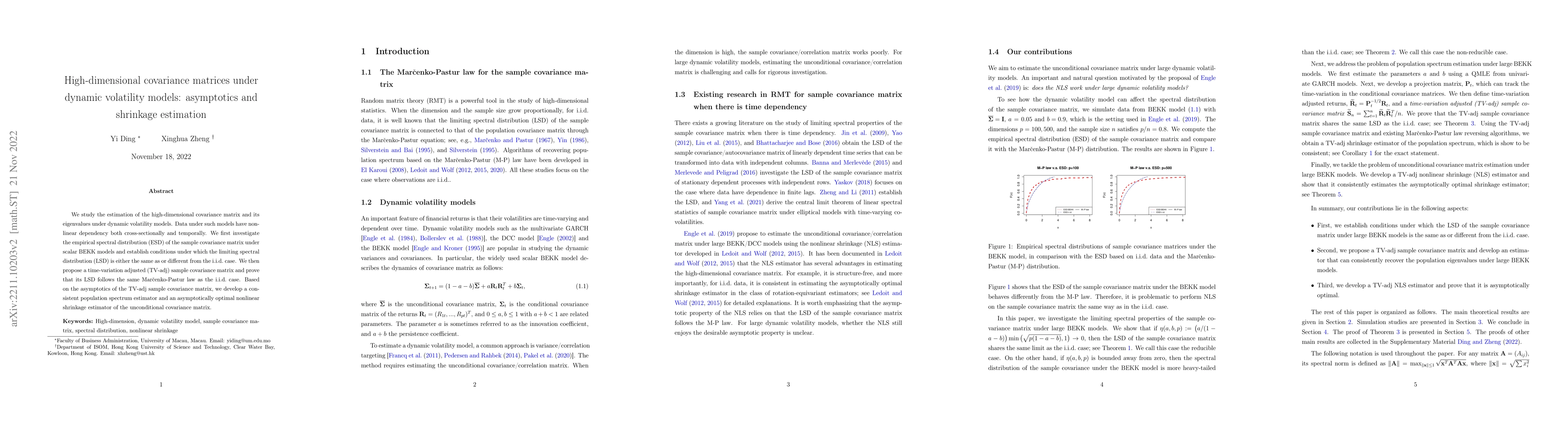

We study the estimation of the high-dimensional covariance matrix andits eigenvalues under dynamic volatility models. Data under such modelshave nonlinear dependency both cross-sectionally and temporally. We firstinvestigate the empirical spectral distribution (ESD) of the sample covariancematrix under scalar BEKK models and establish conditions under which thelimiting spectral distribution (LSD) is either the same as or different fromthe i.i.d. case. We then propose a time-variation adjusted (TV-adj) sample co-variance matrix and prove that its LSD follows the same Marcenko-Pasturlaw as the i.i.d. case. Based on the asymptotics of the TV-adj sample co-variance matrix, we develop a consistent population spectrum estimator and an asymptotically optimal nonlinear shrinkage estimator of the unconditionalcovariance matrix

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)