Summary

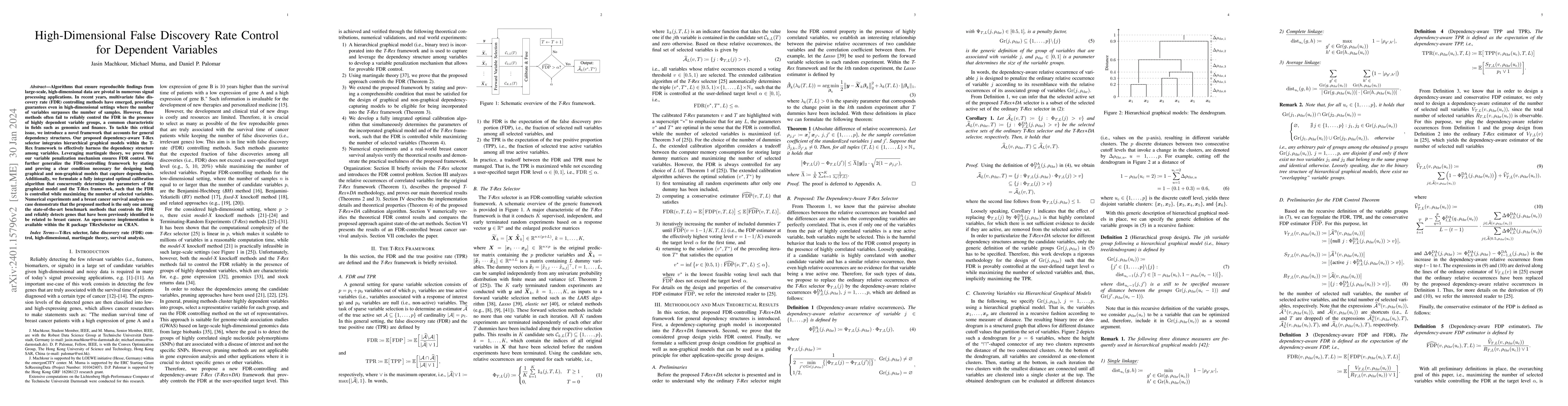

Algorithms that ensure reproducible findings from large-scale, high-dimensional data are pivotal in numerous signal processing applications. In recent years, multivariate false discovery rate (FDR) controlling methods have emerged, providing guarantees even in high-dimensional settings where the number of variables surpasses the number of samples. However, these methods often fail to reliably control the FDR in the presence of highly dependent variable groups, a common characteristic in fields such as genomics and finance. To tackle this critical issue, we introduce a novel framework that accounts for general dependency structures. Our proposed dependency-aware T-Rex selector integrates hierarchical graphical models within the T-Rex framework to effectively harness the dependency structure among variables. Leveraging martingale theory, we prove that our variable penalization mechanism ensures FDR control. We further generalize the FDR-controlling framework by stating and proving a clear condition necessary for designing both graphical and non-graphical models that capture dependencies. Additionally, we formulate a fully integrated optimal calibration algorithm that concurrently determines the parameters of the graphical model and the T-Rex framework, such that the FDR is controlled while maximizing the number of selected variables. Numerical experiments and a breast cancer survival analysis use-case demonstrate that the proposed method is the only one among the state-of-the-art benchmark methods that controls the FDR and reliably detects genes that have been previously identified to be related to breast cancer. An open-source implementation is available within the R package TRexSelector on CRAN.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHierarchical False Discovery Rate Control for High-dimensional Survival Analysis with Interactions

Shuangge Ma, Qingzhao Zhang, Weijuan Liang

Model-free High Dimensional Mediator Selection with False Discovery Rate Control

Ziyang Xu, Cheng Zheng, Ran Dai et al.

SyNPar: Synthetic Null Data Parallelism for High-Power False Discovery Rate Control in High-Dimensional Variable Selection

Ziheng Zhang, Changhu Wang, Jingyi Jessica Li

| Title | Authors | Year | Actions |

|---|

Comments (0)