Summary

In this paper we extend the market-making models with inventory constraints of Avellaneda and Stoikov ("High-frequency trading in a limit-order book", Quantitative Finance Vol.8 No.3 2008) and Gueant, Lehalle and Fernandez-Tapia ("Dealing with inventory risk", Preprint 2011) to the case of a rather general class of mid-price processes, under either exponential or linear PNL utility functions, and we add an inventory-risk-aversion parameter that penalises the marker-maker if she finishes her day with a non-zero inventory. This general, non-martingale framework allows a market-maker to make directional bets on market trends whilst keeping under control her inventory risk. In order to achieve this, the marker-maker places non-symmetric limit orders that favour market orders to hit her bid (resp. ask) quotes if she expects that prices will go up (resp. down). With this inventory-risk-aversion parameter, the market-maker has not only direct control on her inventory risk but she also has indirect control on the moments of her PNL distribution. Therefore, this parameter can be seen as a fine-tuning of the marker-maker's risk-reward profile. In the case of a mean-reverting mid-price, we show numerically that the inventory-risk-aversion parameter gives the market-maker enough room to tailor her risk-reward profile, depending on her risk budgets in inventory and PNL distribution (especially variance, skewness, kurtosis and VaR). For example, when compared to the martingale benchmark, a market can choose to either increase her average PNL by more than 15% and carry a huge risk, on inventory and PNL, or either give up 5% of her benchmark PNL to increase her control on inventory and PNL, as well as increasing her Sharpe ratio by a factor bigger than 2.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

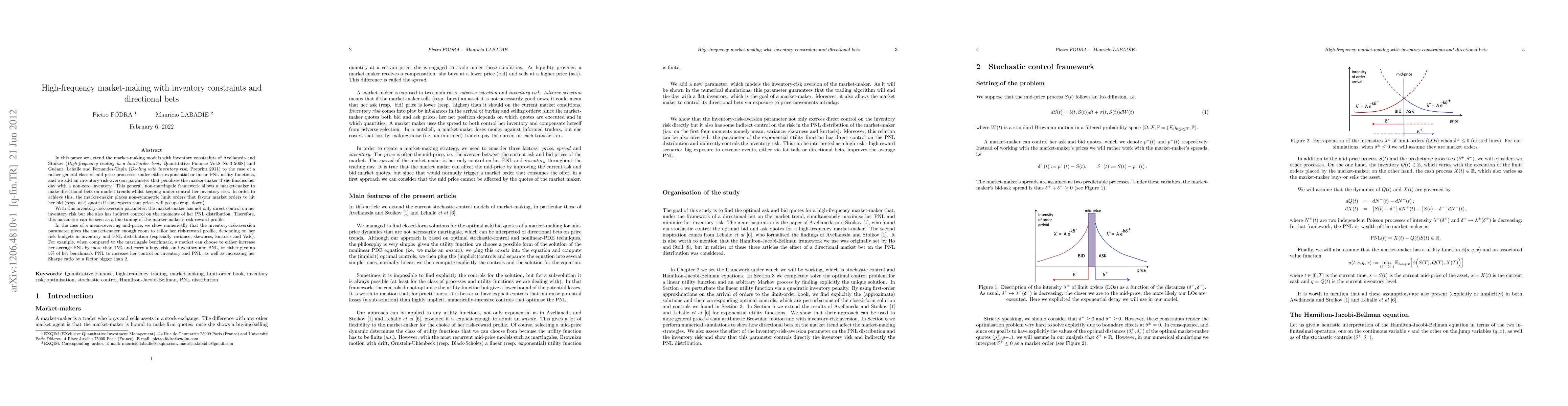

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersResolving Latency and Inventory Risk in Market Making with Reinforcement Learning

Bo Li, Chang Yang, Xiao Huang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)