Authors

Summary

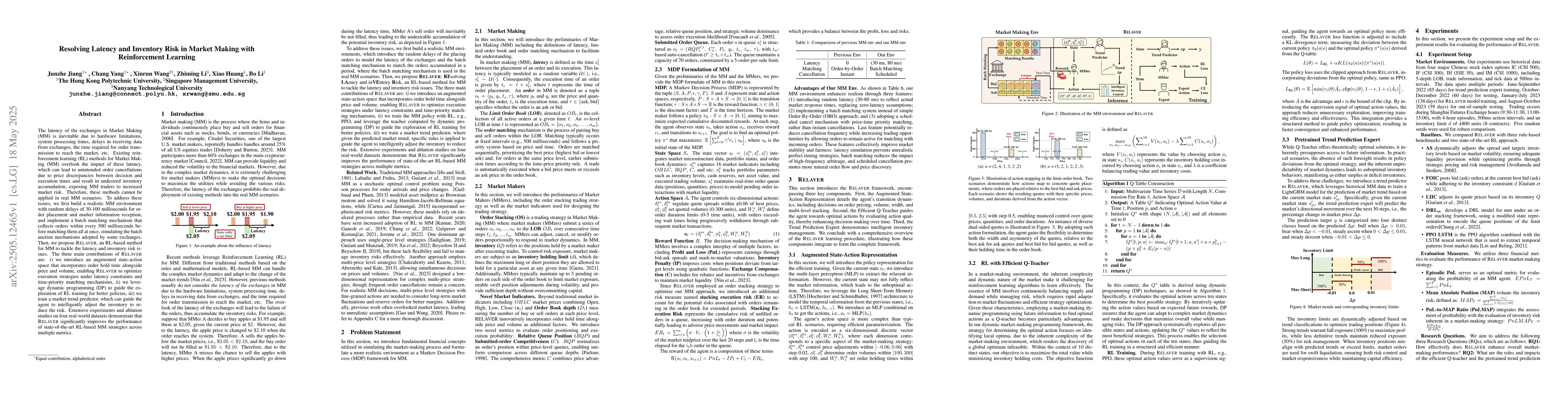

The latency of the exchanges in Market Making (MM) is inevitable due to hardware limitations, system processing times, delays in receiving data from exchanges, the time required for order transmission to reach the market, etc. Existing reinforcement learning (RL) methods for Market Making (MM) overlook the impact of these latency, which can lead to unintended order cancellations due to price discrepancies between decision and execution times and result in undesired inventory accumulation, exposing MM traders to increased market risk. Therefore, these methods cannot be applied in real MM scenarios. To address these issues, we first build a realistic MM environment with random delays of 30-100 milliseconds for order placement and market information reception, and implement a batch matching mechanism that collects orders within every 500 milliseconds before matching them all at once, simulating the batch auction mechanisms adopted by some exchanges. Then, we propose Relaver, an RL-based method for MM to tackle the latency and inventory risk issues. The three main contributions of Relaver are: i) we introduce an augmented state-action space that incorporates order hold time alongside price and volume, enabling Relaver to optimize execution strategies under latency constraints and time-priority matching mechanisms, ii) we leverage dynamic programming (DP) to guide the exploration of RL training for better policies, iii) we train a market trend predictor, which can guide the agent to intelligently adjust the inventory to reduce the risk. Extensive experiments and ablation studies on four real-world datasets demonstrate that \textsc{Relaver} significantly improves the performance of state-of-the-art RL-based MM strategies across multiple metrics.

AI Key Findings

Generated Jun 08, 2025

Methodology

The research constructs a realistic market-making environment with simulated latency and batch matching, then proposes Relaver, an RL-based method to address latency and inventory risks in MM.

Key Results

- Relaver significantly improves the performance of RL-based MM strategies across multiple metrics.

- Relaver optimizes execution strategies under latency constraints using an augmented state-action space incorporating order hold time.

Significance

This research is important as it directly tackles latency and inventory risks faced by market makers, which existing RL methods overlook, and presents a solution applicable to real MM scenarios.

Technical Contribution

The introduction of Relaver, an RL method that incorporates order hold time in its state-action space and uses dynamic programming to guide exploration, is the main technical contribution.

Novelty

Relaver's novelty lies in its augmented state-action space that accounts for order hold time and its use of dynamic programming to enhance RL training, addressing critical latency and inventory risks in market making.

Limitations

- The paper does not discuss potential limitations of the proposed method in highly volatile or extreme market conditions.

- Generalizability of Relaver to unseen or drastically different market datasets is not explicitly addressed.

Future Work

- Investigate the robustness of Relaver in extreme market conditions or during flash crashes.

- Explore the applicability of Relaver to other financial instruments or markets beyond those tested in the paper.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMarket Making via Reinforcement Learning in China Commodity Market

Junshu Jiang, Thomas Dierckx, Wim Schoutens et al.

No citations found for this paper.

Comments (0)