Summary

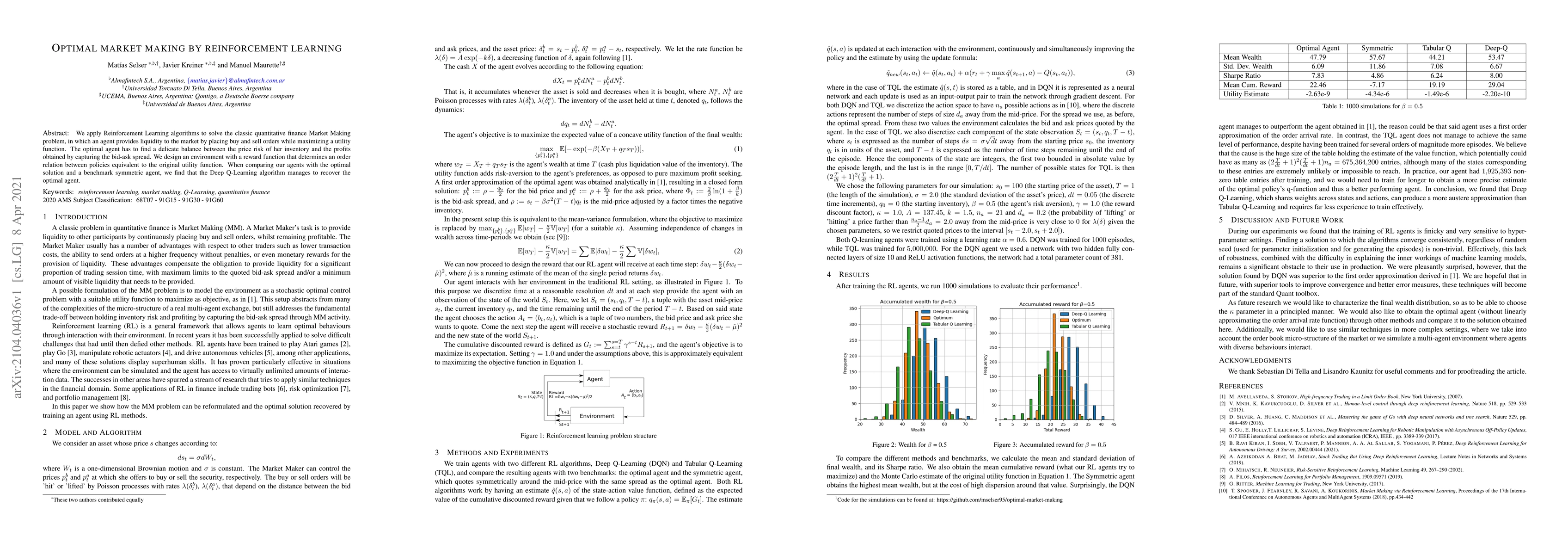

We apply Reinforcement Learning algorithms to solve the classic quantitative finance Market Making problem, in which an agent provides liquidity to the market by placing buy and sell orders while maximizing a utility function. The optimal agent has to find a delicate balance between the price risk of her inventory and the profits obtained by capturing the bid-ask spread. We design an environment with a reward function that determines an order relation between policies equivalent to the original utility function. When comparing our agents with the optimal solution and a benchmark symmetric agent, we find that the Deep Q-Learning algorithm manages to recover the optimal agent.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOver-the-Counter Market Making via Reinforcement Learning

Zhou Fang, Haiqing Xu

| Title | Authors | Year | Actions |

|---|

Comments (0)