Summary

In usual stochastic volatility models, the process driving the volatility of the asset price evolves according to an autonomous one-dimensional stochastic differential equation. We assume that the coefficients of this equation are smooth. Using It\^o's formula, we get rid, in the asset price dynamics, of the stochastic integral with respect to the Brownian motion driving this SDE. Taking advantage of this structure, we propose - a scheme, based on the Milstein discretization of this SDE, with order one of weak trajectorial convergence for the asset price, - a scheme, based on the Ninomiya-Victoir discretization of this SDE, with order two of weak convergence for the asset price. We also propose a specific scheme with improved convergence properties when the volatility of the asset price is driven by an Orstein-Uhlenbeck process. We confirm the theoretical rates of convergence by numerical experiments and show that our schemes are well adapted to the multilevel Monte Carlo method introduced by Giles [2008a, 2008b].

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

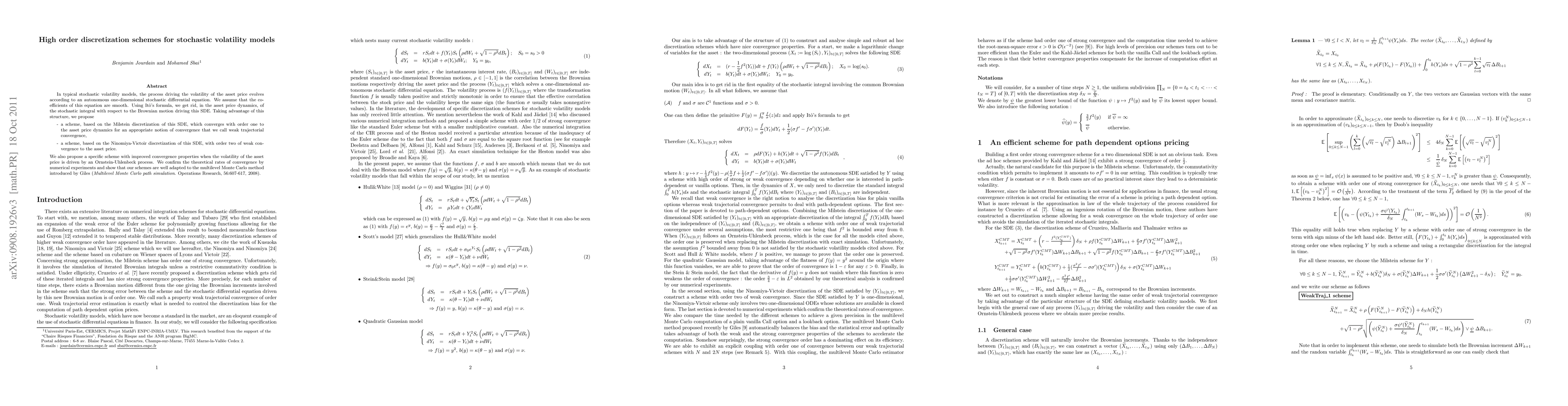

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTime-adaptive high-order compact finite difference schemes for option pricing in a family of stochastic volatility models

Bertram Düring, Christof Heuer

| Title | Authors | Year | Actions |

|---|

Comments (0)