Summary

In the present work, a novel second-order approximation for ATM option prices is derived for a large class of exponential L\'{e}vy models with or without Brownian component. The results hereafter shed new light on the connection between both the volatility of the continuous component and the jump parameters and the behavior of ATM option prices near expiration. In the presence of a Brownian component, the second-order term, in time-$t$, is of the form $d_{2}\,t^{(3-Y)/2}$, with $d_{2}$ only depending on $Y$, the degree of jump activity, on $\sigma$, the volatility of the continuous component, and on an additional parameter controlling the intensity of the "small" jumps (regardless of their signs). This extends the well known result that the leading first-order term is $\sigma t^{1/2}/\sqrt{2\pi}$. In contrast, under a pure-jump model, the dependence on $Y$ and on the separate intensities of negative and positive small jumps are already reflected in the leading term, which is of the form $d_{1}t^{1/Y}$. The second-order term is shown to be of the form $\tilde{d}_{2} t$ and, therefore, its order of decay turns out to be independent of $Y$. The asymptotic behavior of the corresponding Black-Scholes implied volatilities is also addressed. Our approach is sufficiently general to cover a wide class of L\'{e}vy processes which satisfy the latter property and whose L\'{e}vy densitiy can be closely approximated by a stable density near the origin. Our numerical results show that the first-order term typically exhibits rather poor performance and that the second-order term can significantly improve the approximation's accuracy, particularly in the absence of a Brownian component.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

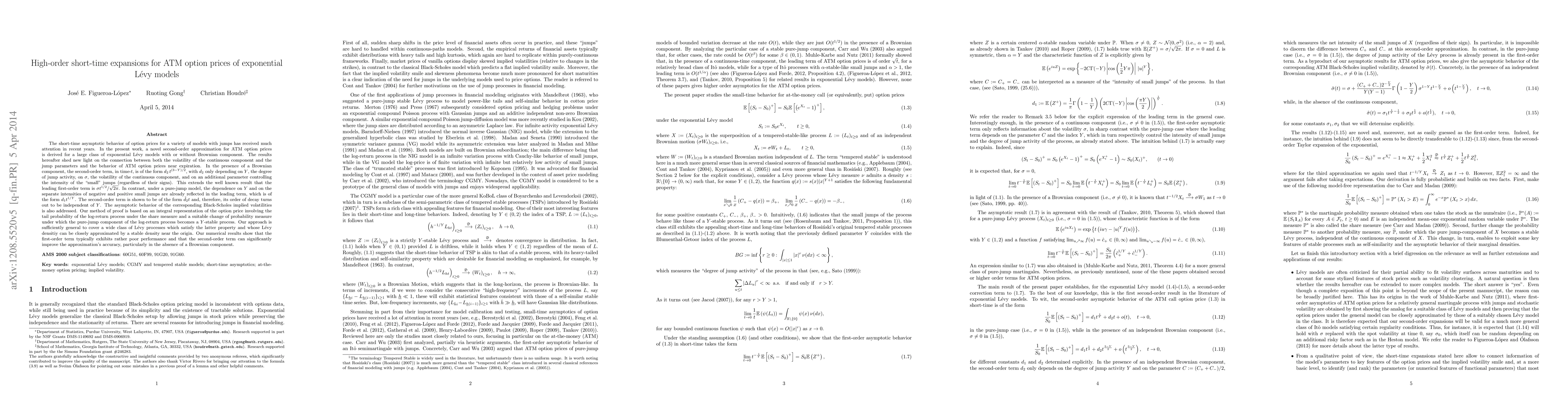

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)