Summary

We consider a stochastic volatility model with L\'evy jumps for a log-return process $Z=(Z_{t})_{t\geq 0}$ of the form $Z=U+X$, where $U=(U_{t})_{t\geq 0}$ is a classical stochastic volatility process and $X=(X_{t})_{t\geq 0}$ is an independent L\'evy process with absolutely continuous L\'evy measure $\nu$. Small-time expansions, of arbitrary polynomial order, in time-$t$, are obtained for the tails $\bbp(Z_{t}\geq z)$, $z>0$, and for the call-option prices $\bbe(e^{z+Z_{t}}-1)_{+}$, $z\neq 0$, assuming smoothness conditions on the {\PaleGrey density of $\nu$} away from the origin and a small-time large deviation principle on $U$. Our approach allows for a unified treatment of general payoff functions of the form $\phi(x){\bf 1}_{x\geq{}z}$ for smooth functions $\phi$ and $z>0$. As a consequence of our tail expansions, the polynomial expansions in $t$ of the transition densities $f_{t}$ are also {\Green obtained} under mild conditions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

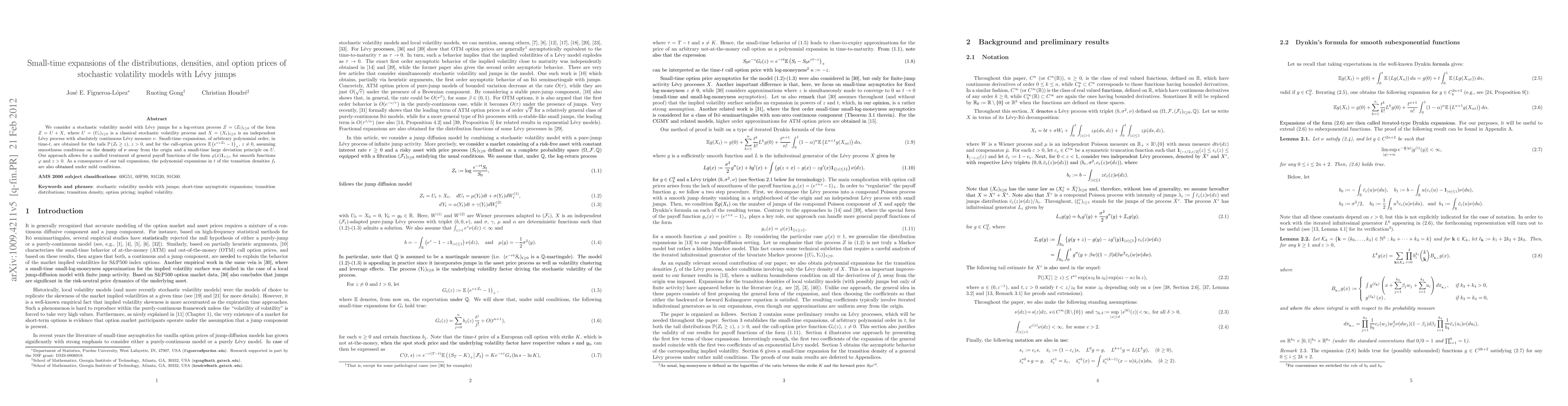

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)