Authors

Summary

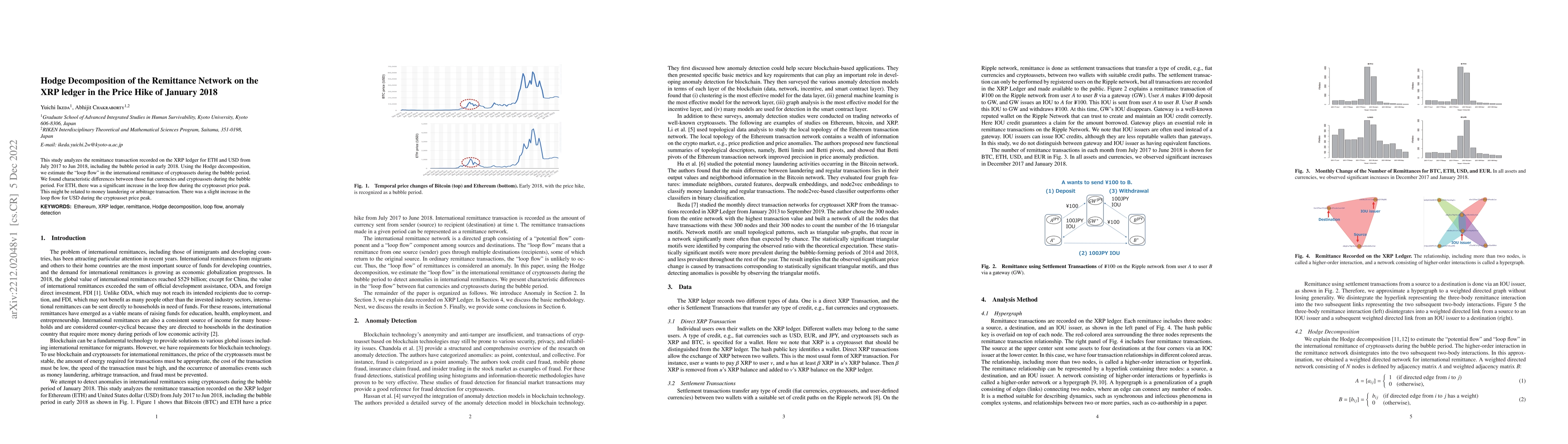

This study analyzes the remittance transaction recorded on the XRP ledger for ETH and USD from July 2017 to Jun 2018, including the bubble period in early 2018. Using the Hodge decomposition, we estimate the ``loop flow'' in the international remittance of cryptoassets during the bubble period. We found characteristic differences between those fiat currencies and cryptoassets during the bubble period. For ETH, there was a significant increase in the loop flow during the cryptoasset price peak. This might be related to money laundering or arbitrage transaction. There was a slight increase in the loop flow for USD during the cryptoasset price peak.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTopology Analysis of the XRP Ledger

Radu State, Vytautas Tumas, Sean Rivera et al.

Projecting XRP price burst by correlation tensor spectra of transaction networks

Abhijit Chakraborty, Tetsuo Hatsuda, Yuichi Ikeda

| Title | Authors | Year | Actions |

|---|

Comments (0)