Summary

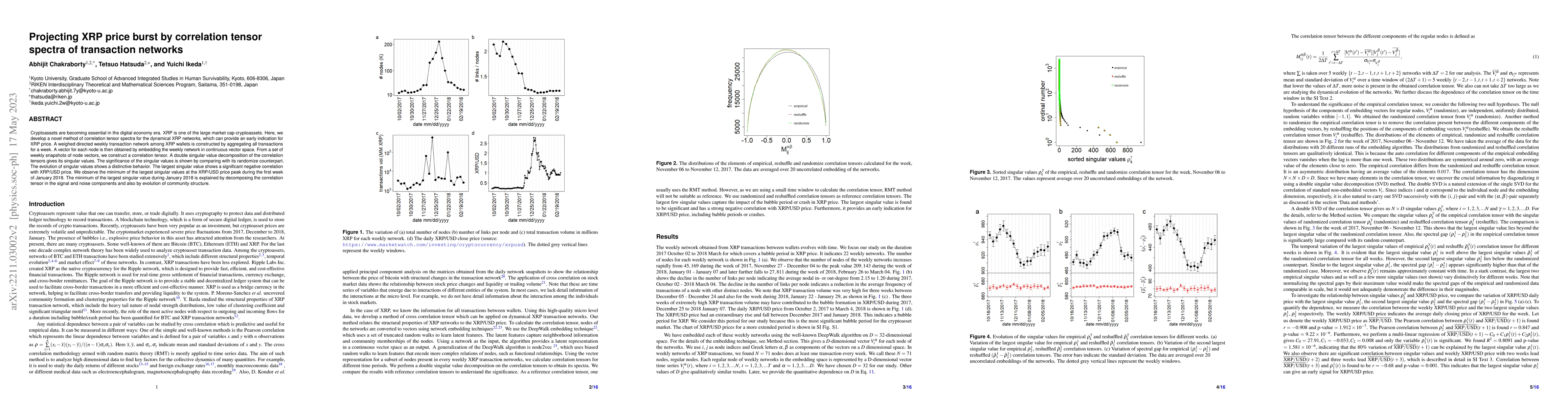

Cryptoassets are becoming essential in the digital economy era. XRP is one of the large market cap cryptoassets. Here, we develop a novel method of correlation tensor spectra for the dynamical XRP networks, which can provide an early indication for XRP price. A weighed directed weekly transaction network among XRP wallets is constructed by aggregating all transactions for a week. A vector for each node is then obtained by embedding the weekly network in continuous vector space. From a set of weekly snapshots of node vectors, we construct a correlation tensor. A double singular value decomposition of the correlation tensors gives its singular values. The significance of the singular values is shown by comparing with its randomize counterpart. The evolution of singular values shows a distinctive behavior. The largest singular value shows a significant negative correlation with XRP/USD price. We observe the minimum of the largest singular values at the XRP/USD price peak during the first week of January 2018. The minimum of the largest singular value during January 2018 is explained by decomposing the correlation tensor in the signal and noise components and also by evolution of community structure.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersArbitrage impact on the relationship between XRP price and correlation tensor spectra of transaction networks

Abhijit Chakraborty, Yuichi Ikeda

Dynamic relationship between XRP price and correlation tensor spectra of the transaction network

Abhijit Chakraborty, Tetsuo Hatsuda, Yuichi Ikeda

Embedding and correlation tensor for XRP transaction networks

Abhijit Chakraborty, Tetsuo Hatsuda, Yuichi Ikeda

Hodge Decomposition of the Remittance Network on the XRP ledger in the Price Hike of January 2018

Abhijit Chakraborty, Yuichi Ikeda

| Title | Authors | Year | Actions |

|---|

Comments (0)