Authors

Summary

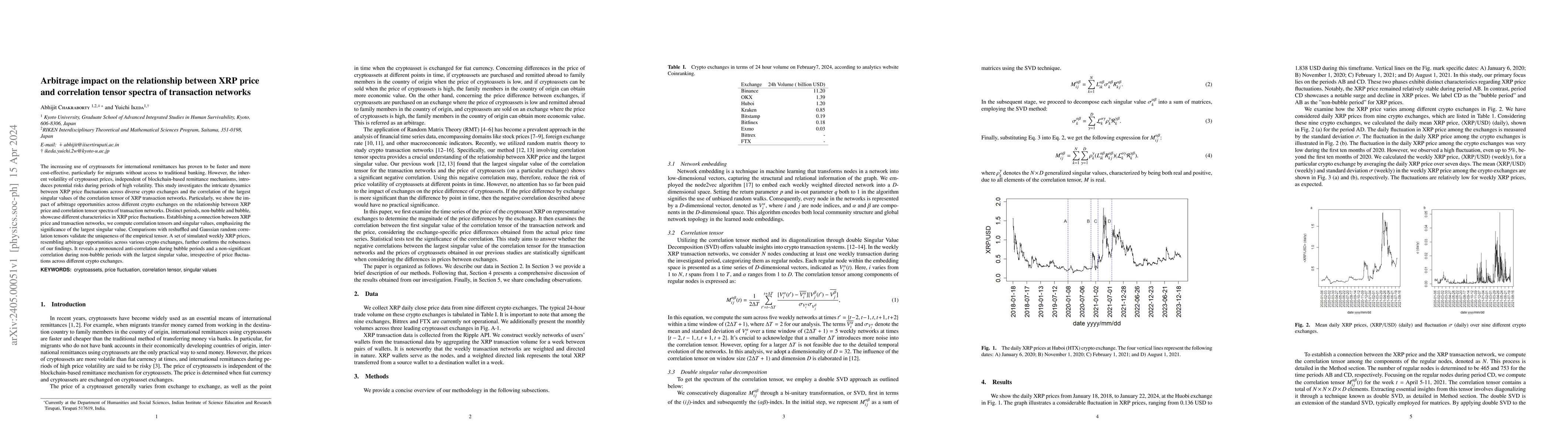

The increasing use of cryptoassets for international remittances has proven to be faster and more cost-effective, particularly for migrants without access to traditional banking. However, the inherent volatility of cryptoasset prices, independent of blockchain-based remittance mechanisms, introduces potential risks during periods of high volatility. This study investigates the intricate dynamics between XRP price fluctuations across diverse crypto exchanges and the correlation of the largest singular values of the correlation tensor of XRP transaction networks. Particularly, we show the impact of arbitrage opportunities across different crypto exchanges on the relationship between XRP price and correlation tensor spectra of transaction networks. Distinct periods, non-bubble and bubble, showcase different characteristics in XRP price fluctuations. Establishing a connection between XRP price and transaction networks, we compute correlation tensors and singular values, emphasizing the significance of the largest singular value. Comparisons with reshuffled and Gaussian random correlation tensors validate the uniqueness of the empirical tensor. A set of simulated weekly XRP prices, resembling arbitrage opportunities across various crypto exchanges, further confirms the robustness of our findings. It reveals a pronounced anti-correlation during bubble periods and a non-significant correlation during non-bubble periods with the largest singular value, irrespective of price fluctuations across different crypto exchanges.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDynamic relationship between XRP price and correlation tensor spectra of the transaction network

Abhijit Chakraborty, Tetsuo Hatsuda, Yuichi Ikeda

Projecting XRP price burst by correlation tensor spectra of transaction networks

Abhijit Chakraborty, Tetsuo Hatsuda, Yuichi Ikeda

Embedding and correlation tensor for XRP transaction networks

Abhijit Chakraborty, Tetsuo Hatsuda, Yuichi Ikeda

Hodge Decomposition of the Remittance Network on the XRP ledger in the Price Hike of January 2018

Abhijit Chakraborty, Yuichi Ikeda

No citations found for this paper.

Comments (0)