Summary

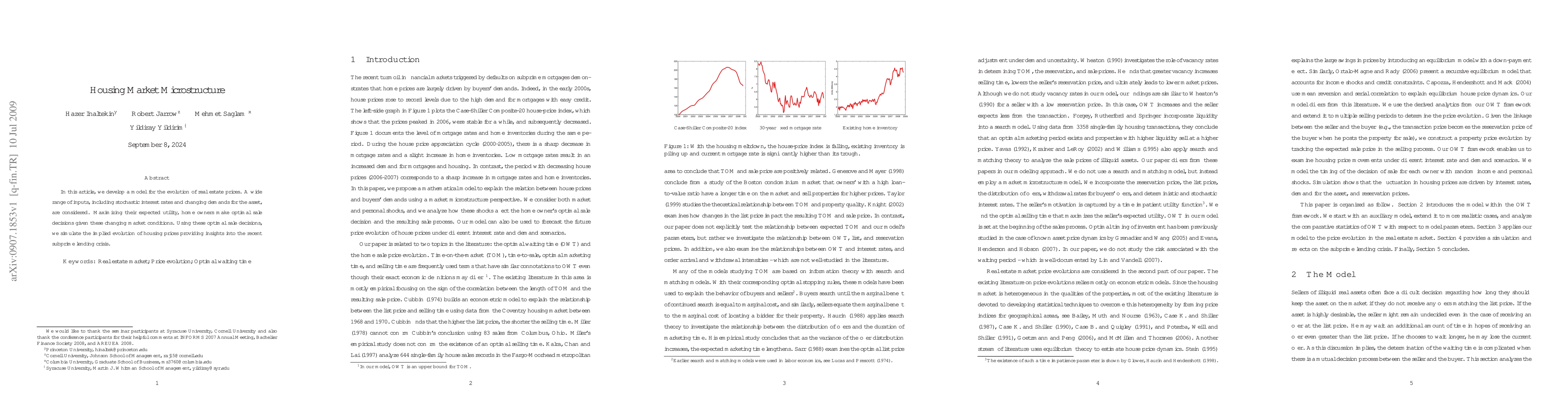

In this article, we develop a model for the evolution of real estate prices. A wide range of inputs, including stochastic interest rates and changing demands for the asset, are considered. Maximizing their expected utility, home owners make optimal sale decisions given these changing market conditions. Using these optimal sale decisions, we simulate the implied evolution of housing prices providing insights into the recent subprime lending crisis.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHousing Forecasts via Stock Market Indicators

Laura P. Schaposnik, Varun Mittal

Housing Market Forecasting using Home Showing Events

Vadim Sokolov, Yuanyuan Zha, Susan T. Parker et al.

The Computational Complexity of the Housing Market

Alexander Teytelboym, Edwin Lock, Zephyr Qiu

| Title | Authors | Year | Actions |

|---|

Comments (0)