Summary

The proper design of automated market makers (AMMs) is crucial to enable the continuous trading of assets represented as digital tokens on markets of cryptoeconomic systems. Improperly designed AMMs can make such markets suffer from the thin market problem (TMP), which can cause cryptoeconomic systems to fail their purposes. We developed an AMM taxonomy that showcases AMM design characteristics. Based on the AMM taxonomy, we devised AMM archetypes implementing principal solution approaches for the TMP. The main purpose of this article is to support practitioners and researchers in tackling the TMP through proper AMM designs.

AI Key Findings

Generated Sep 06, 2025

Methodology

A comprehensive analysis of 110 AMMs was conducted, including a review of official whitepapers, blog articles, and official documentation.

Key Results

- Main finding: The Price-discovering LP-based AMM is the most widespread type, with 98 occurrences.

- Main finding: Most AMMs have non-translation invariant designs, which can lead to inefficiencies in liquidity provision.

- Main finding: The Price-discovering Supply-sovereign AMM excels in token issuance, allowing issuers to define supply curves for predictable price evolution.

Significance

This research provides a conceptual foundation for AMM design, enabling comparisons between different design options and informing better-informed decisions.

Technical Contribution

The proposed AMM taxonomy provides a standardized framework for classifying AMM designs, enabling better comparison and analysis.

Novelty

This work introduces a novel approach to AMM design classification, leveraging a combination of quantitative and qualitative methods to identify key characteristics.

Limitations

- Limited scope: The analysis was restricted to publicly available information, which may not reflect the full range of AMM designs.

- Inadequate data: Some AMMs were missing critical details necessary for classification into the taxonomy.

Future Work

- Investigating the impact of external price oracles on the performance of Price-adopting LP-based AMMs

- Developing a more comprehensive understanding of the relationship between liquidity provision and token prices in AMM designs

Paper Details

PDF Preview

Key Terms

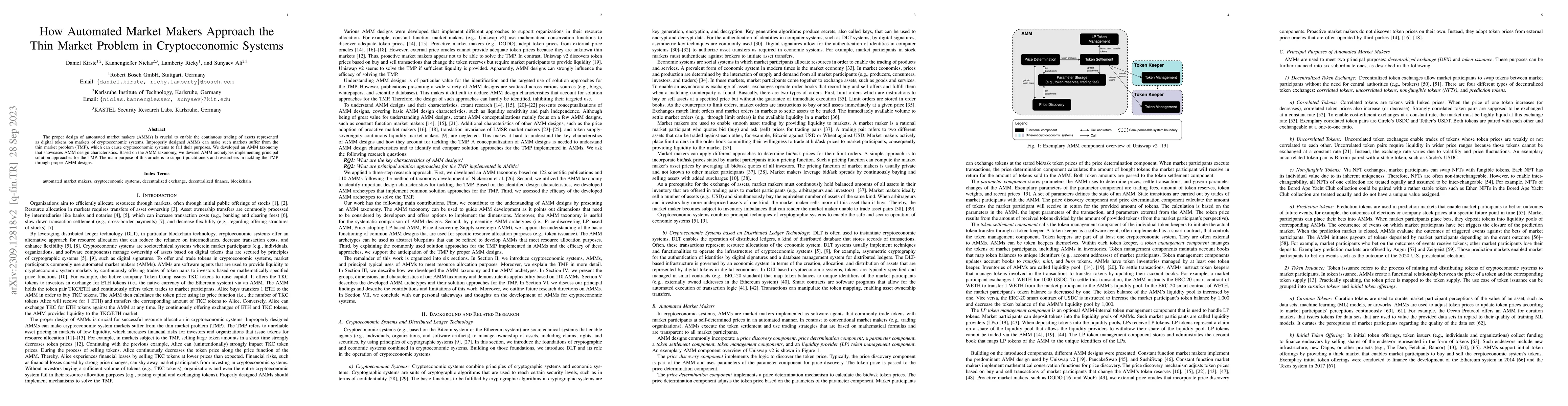

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDelta Hedging Liquidity Positions on Automated Market Makers

Xi Chen, Adam Khakhar

| Title | Authors | Year | Actions |

|---|

Comments (0)