Summary

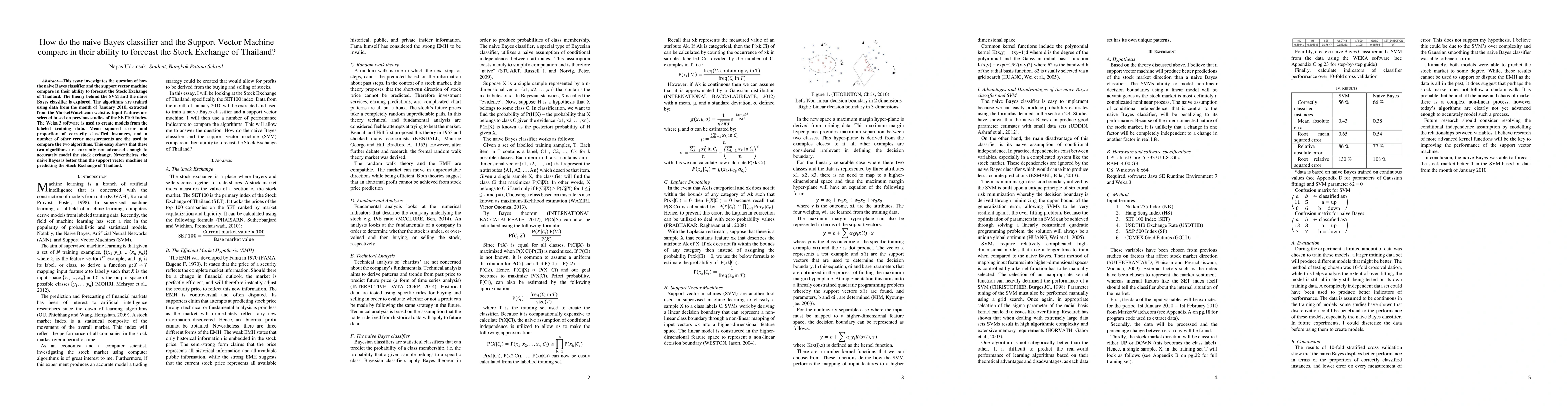

This essay investigates the question of how the naive Bayes classifier and the support vector machine compare in their ability to forecast the Stock Exchange of Thailand. The theory behind the SVM and the naive Bayes classifier is explored. The algorithms are trained using data from the month of January 2010, extracted from the MarketWatch.com website. Input features are selected based on previous studies of the SET100 Index. The Weka 3 software is used to create models from the labeled training data. Mean squared error and proportion of correctly classified instances, and a number of other error measurements are the used to compare the two algorithms. This essay shows that these two algorithms are currently not advanced enough to accurately model the stock exchange. Nevertheless, the naive Bayes is better than the support vector machine at predicting the Stock Exchange of Thailand.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAn Efficient Shapley Value Computation for the Naive Bayes Classifier

Vincent Lemaire, Marc Boullé, Fabrice Clérot

| Title | Authors | Year | Actions |

|---|

Comments (0)