Authors

Summary

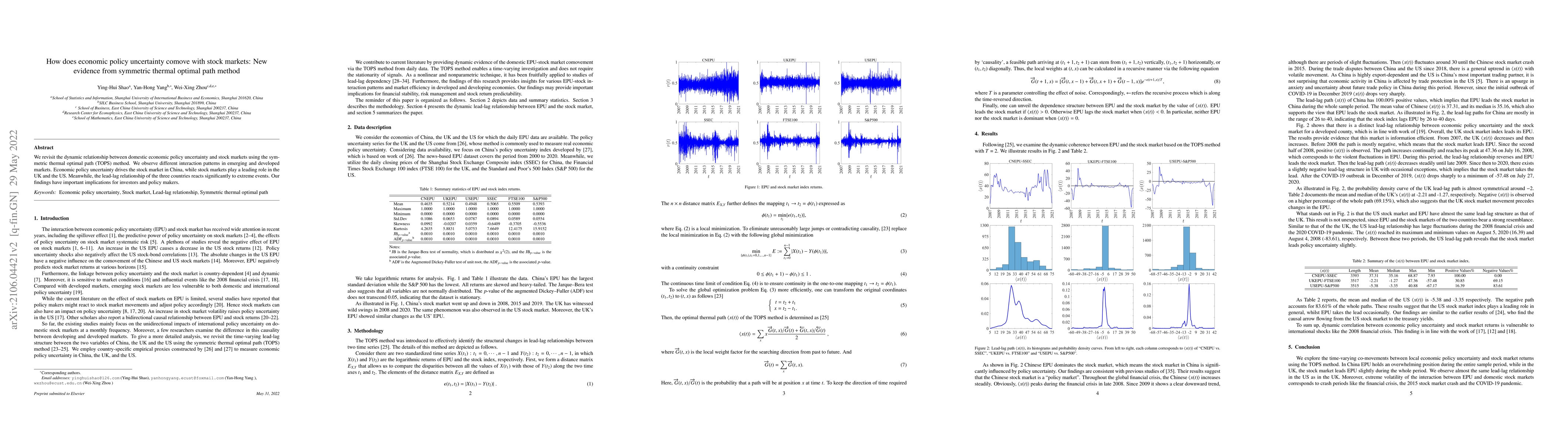

We revisit the dynamic relationship between domestic economic policy uncertainty and stock markets using the symmetric thermal optimal path (TOPS) method. We observe different interaction patterns in emerging and developed markets. Economic policy uncertainty drives the stock market in China, while stock markets play a leading role in the UK and the US. Meanwhile, the lead-lag relationship of the three countries reacts significantly to extreme events. Our findings have important implications for investors and policy makers.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)