Summary

In frictionless financial markets, no-arbitrage is a local property in time. This means that a discrete time model is arbitrage-free if and only if there does not exist a one-period-arbitrage. With capital gains taxes, this equivalence fails. For a model with a linear tax and one non-shortable risky stock, we introduce the concept of robust local no-arbitrage (RLNA) as the weakest local condition which guarantees dynamic no-arbitrage. Under a sharp dichotomy condition, we prove (RLNA). Since no-one-period-arbitrage is necessary for no-arbitrage, the latter is sandwiched between two local conditions, which allows us to estimate its non-locality. Furthermore, we construct a stock price process such that two long positions in the same stock hedge each other. This puzzling phenomenon that cannot occur in arbitrage-free frictionless markets (or markets with proportional transaction costs) is used to show that no-arbitrage alone does not imply the existence of an equivalent separating measure if the probability space is infinite. Finally, we show that the model with a linear tax on capital gains can be written as a model with proportional transaction costs by introducing several fictitious securities.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

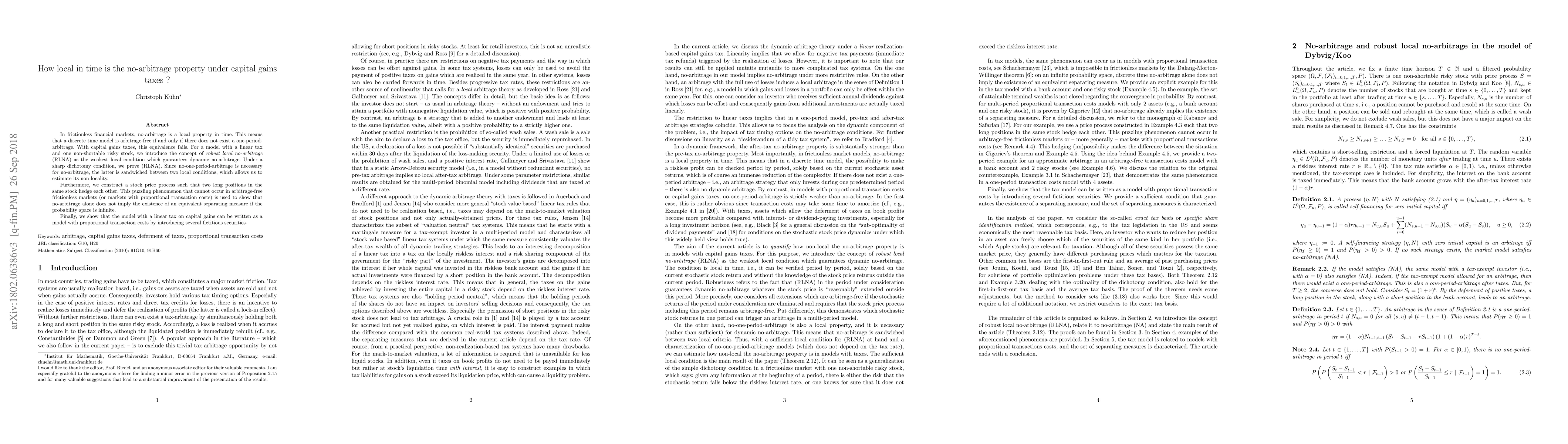

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRobust No-Arbitrage under Projective Determinacy

Laurence Carassus, Alexandre Boistard, Safae Issaoui

| Title | Authors | Year | Actions |

|---|

Comments (0)