Summary

We generalize Merton's asset valuation approach to systems of multiple financial firms where cross-ownership of equities and liabilities is present. The liabilities, which may include debts and derivatives, can be of differing seniority. We derive equations for the prices of equities and recovery claims under no-arbitrage. An existence result and a uniqueness result are proven. Examples and an algorithm for the simultaneous calculation of all no-arbitrage prices are provided. A result on capital structure irrelevance for groups of firms regarding externally held claims is discussed, as well as financial leverage and systemic risk caused by cross-ownership.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

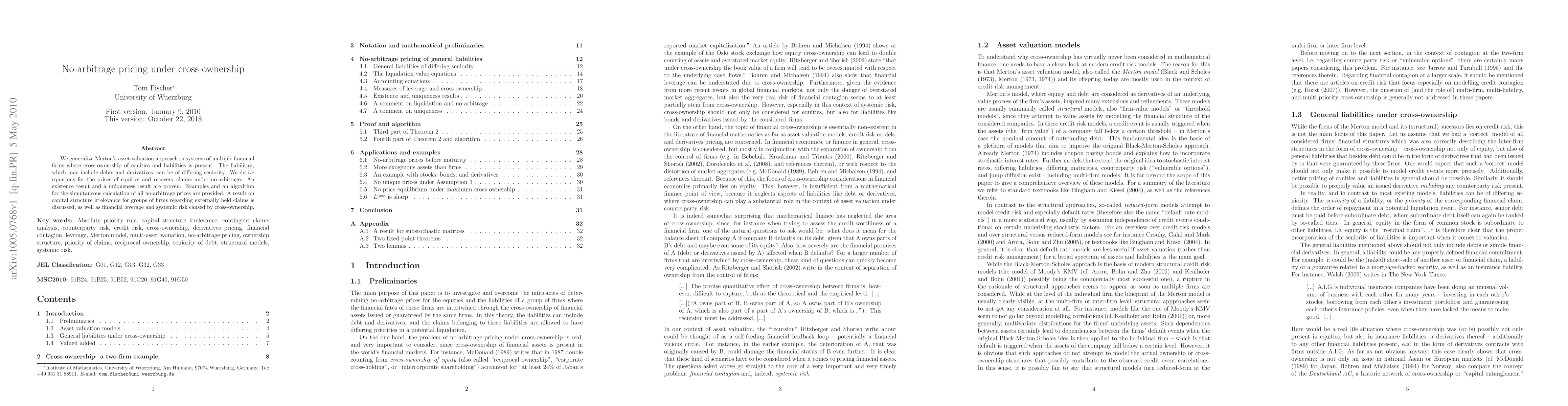

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)