Summary

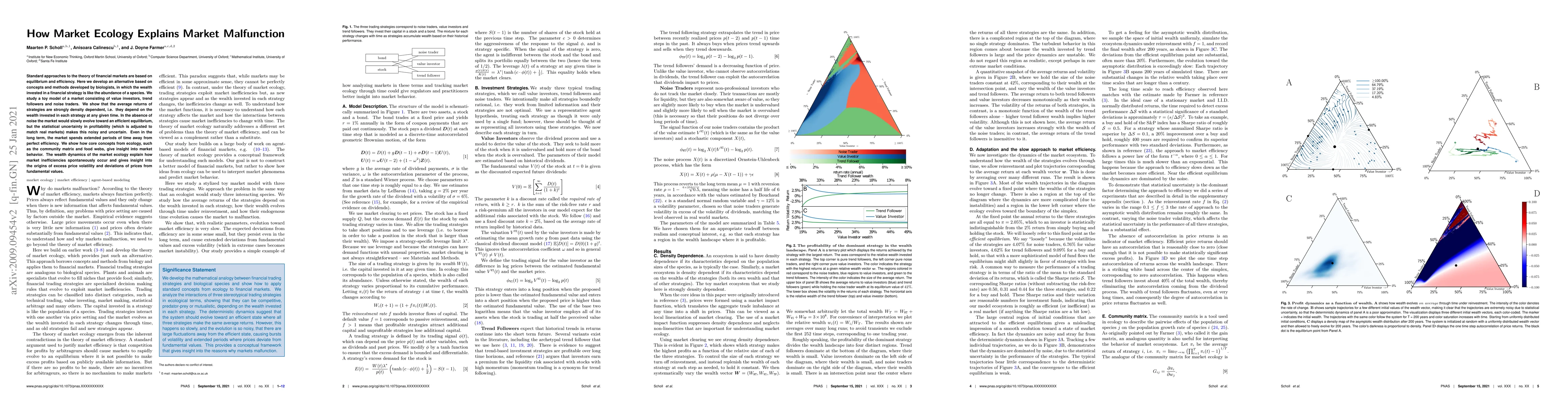

Standard approaches to the theory of financial markets are based on equilibrium and efficiency. Here we develop an alternative based on concepts and methods developed by biologists, in which the wealth invested in a financial strategy is like the abundance of a species. We study a toy model of a market consisting of value investors, trend followers and noise traders. We show that the average returns of strategies are strongly density dependent, i.e. they depend on the wealth invested in each strategy at any given time. In the absence of noise the market would slowly evolve toward an efficient equilibrium, but the statistical uncertainty in profitability (which is adjusted to match real markets) makes this noisy and uncertain. Even in the long term, the market spends extended periods of time away from perfect efficiency. We show how core concepts from ecology, such as the community matrix and food webs, give insight into market behavior. The wealth dynamics of the market ecology explain how market inefficiencies spontaneously occur and gives insight into the origins of excess price volatility and deviations of prices from fundamental values.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTowards Evology: a Market Ecology Agent-Based Model of US Equity Mutual Funds

Alissa M. Kleinnijenhuis, J. Doyne Farmer, Aymeric Vie et al.

Bounded strategic reasoning explains crisis emergence in multi-agent market games

Benjamin Patrick Evans, Mikhail Prokopenko

| Title | Authors | Year | Actions |

|---|

Comments (0)